The soaring cost of Canadian homes has been a hot topic recently, as many prospective homebuyers are struggling to afford even modest dwellings. In this article, we’ll delve deep into the reasons behind the skyrocketing housing prices in Canada, drawing from reputable sources to provide a comprehensive understanding of the situation.

Factors Contributing to High Housing Prices in Canada

Housing prices in Canada have been on an upward trajectory for years. But what are the driving forces behind this trend?

Supply and Demand

In research by statista.com, says the limited availability of land for development and strict zoning regulations limit the number of new homes being built, thus driving up prices.

Additionally, Canada’s growing population, combined with low-interest rates, has led to a strong demand for housing, pushing prices higher.

Interest Rates

Low interest rates make it easier for people to afford mortgages, which drives up housing prices. Low interest rates make borrowing more attractive, leading some people into the real estate market who wouldn’t usually participate.

Immigration

The influx of new immigrants to Canada increases the demand for housing, driving up house prices as supply struggles to meet this growing demand.

This inflow is especially true in cities such as Toronto and Vancouver, which have seen some of the highest rates of immigration in recent years.

Foreign Investment

When foreign investors buy properties intending to resell them at a higher price, it can increase housing prices for everyone.

As a result, foreign investment in Canadian real estate has been a significant factor contributing to high housing prices, particularly in major cities like Toronto and Vancouver.

Stricter Government Regulation

Government regulations, such as those limiting developers’ ability to build, can also contribute to high housing prices. Government regulations also affect zoning, slow down development processes, and create land constraints.

High Rates of Urban Living

A high rate of urban living can contribute to soaring house prices in Canada in a few ways. One is that as more people move into metropolitan areas, the demand for housing increases, which drives up prices.

Additionally, urban areas often have limited land for development, making it more challenging to build new housing, further increasing costs.

Is Canadian Housing Overpriced?

Housing prices in Canada vary depending on location. Still, in some cities, housing prices have risen significantly in recent years, leading some experts to suggest that the market may be overpriced.

But, again, opinions vary, and it is necessary to consider factors such as supply and demand, economic conditions, and government policies when assessing the housing market.

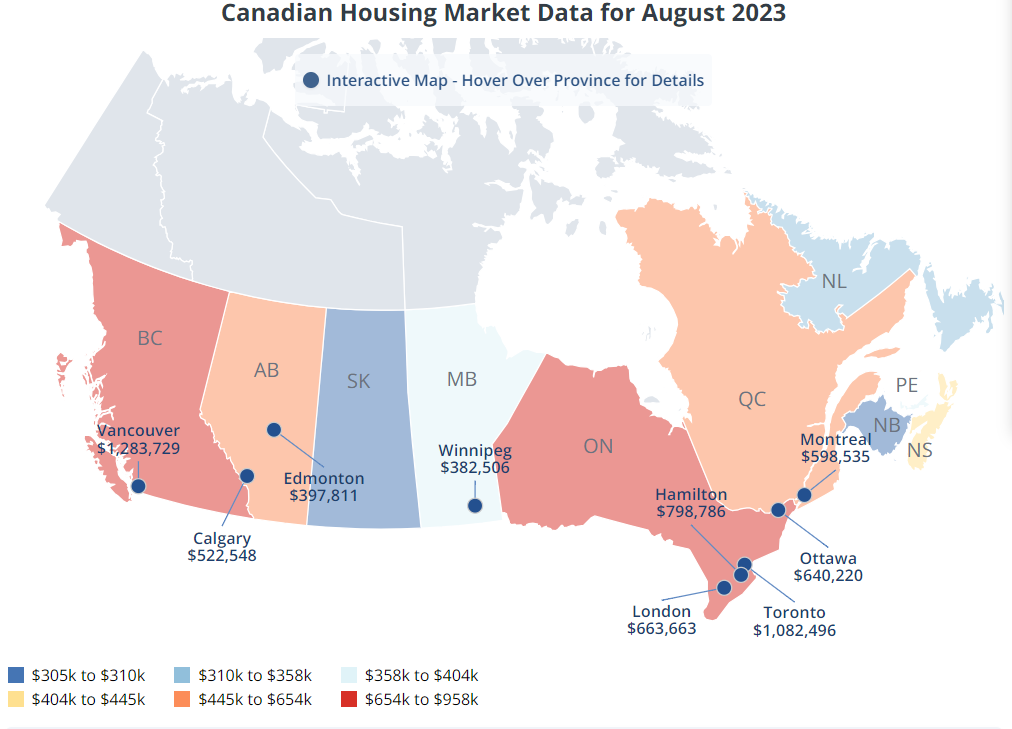

Average housing prices in Canada

Housing prices depend on the location and market conditions. In recent years Canadian housing prices have been rising, particularly in major cities such as Toronto and Vancouver. Average home prices in these two cities alone drive up the national average.

Why are houses so expensive in some Canadian cities?

Housing prices across Canada have been rising for decades, with some cities seeing particularly hefty increases in recent years.

For example, in Toronto, Vancouver, and Montreal specifically, home prices have skyrocketed, making it nearly impossible for many people to buy a home and leading to an affordability crisis in these areas.

What are the cheapest places to live?

If you’re looking for a place in Canada to call home but don’t want to break the bank, you’re in luck! Housing prices and other living costs determine the cheapest places to live in Canada, and there are still a few provinces with housing prices lower than the national average.

The current lowest housing prices are found in Saguenay, Quebec. This city offers some of the most affordable residential real estate, with average house prices at $215,000. This price is drastically lower than in major cities like Toronto and Vancouver, which can exceed One million dollars for an average house.

Saguenay also has a very low cost of living as groceries and transportation are both significantly cheaper than what you would find in bigger cities. And the city is full of skiing, swimming, and snowmobiling activities – they even have their own theater company!

According to the Canadian Real Estate Association, the following places in Canada also offer lower housing prices.

- Newfoundland and Labrador. Throughout the entire province of Newfoundland and Labrador, whose capital city is St. John’s (not to be confused with Saint John, New Brunswick), the average price of a home is $280,200. That figure represents a year-over-year increase of 10.8%.

- St. John, New Brunswick, is the third cheapest place to buy a house in Canada, with an average home price of $294,900.

- Regina Saskatchewan. The average price of a home in Saskatchewan’s capital, Regina (also known as the Queen City), is $322,800, with a year-over-year decrease of 3.5%.

- Quebec City. The average price of a home in Quebec’s census metropolitan area (CMA) is $325,600. That figure represents an annual increase of 11.6%.

- Trois-Rivières, Quebec, has an average home price of $330,431, with a year-over-year increase of 29.5%.

- Thunder Bay, Ontario. The average home price in Thunder Bay is $358,051 and a year-over-year increase of 12.5%.

- Saskatoon, Saskatchewan. The average cost of a home here is $376,100, with a year-over-year increase of 5.4%.

- Edmonton, Alberta. Edmonton’s average home price is $402,800. That figure represents a year-over-year increase of 8.4%.

- Sherbrook Quebec. The average home price here is $435,525, with a year-over-year increase of 12%.

Why are houses in Canada more expensive compared to the US?

Housing prices in Canada have consistently been higher than in the United States since at least 1990. In recent years, Canadian housing prices have seen a much more significant increase than in the US, leading to further disparity between the two countries. This raises the question—why are houses in Canada more expensive than those across the border?

Various factors contribute to this difference, including market dynamics and regional influences. One key factor is government regulations that limit foreign investment and reduce supply.

Additionally, taxes on real estate sales and mortgage interest are higher in Canada than in the US, making it more costly for Canadians to buy a home.

On top of this, land availability is an issue due to geographical constraints imposed by bodies of water such as oceans or lakes and provincial boundaries.

The Historical Perspective

The Boom of the 80s and 90s

How Canadian Real Estate Association says, the late 1980s and early 1990s saw a significant boom in Canadian real estate.

This was due to a combination of economic growth, increased immigration, and favorable government policies.

However, the subsequent recession in the 90s led to a temporary slowdown, only for prices to pick up again in the 2000s.

The 2008 Financial Crisis

Bank of Canada says that the 2008 financial crisis severely impacted housing markets worldwide, Canada’s was relatively insulated. The country’s stringent banking regulations and conservative lending practices meant that the housing market remained stable, even as other countries experienced significant downturns.

Geographical Constraints

Canada, despite its vast size, has a significant portion of its land that is uninhabitable or unsuitable for large-scale development.

The presence of the Rocky Mountains in the west, the Arctic tundra in the north, and vast stretches of boreal forest make large-scale housing development challenging.

Limited Land in Urban Areas

According to a study by Urbanization, cities like Vancouver, surrounded by mountains and the ocean, have limited space to expand. Similarly, Toronto, being bordered by the Greenbelt, has restrictions on suburban sprawl. This limited availability of land in urban centers drives up demand and, consequently, prices.

The Role of Speculation

Domestic Speculation

Domestic investors have played a role in driving up housing prices. With low-interest rates, many Canadians have viewed real estate as a safe and profitable investment, leading to increased demand and higher prices.

Foreign Speculation

Foreign investment, especially from wealthy investors in countries like China and Russia, has been a significant driver of high housing prices, particularly in cities like Vancouver and Toronto. These investors often view Canadian real estate as a stable place to park their money, driving up demand and prices in the process.

Compared with the US Market

While it’s tempting to compare Canadian housing prices to those in the US, it’s essential to consider the differences in market dynamics, regulations, and economic conditions. For instance:

Mortgage Interest Deductibility

In the US, homeowners can deduct mortgage interest from their taxable income, effectively reducing the cost of borrowing. In Canada, this is not the case, making mortgages more expensive for Canadians.

Differences in Construction

The construction industry in Canada faces higher costs due to stricter building codes, longer approval processes, and higher labor costs. These factors can contribute to higher home prices.

Looking Ahead

While predicting the future of the housing market is always tricky, several factors will likely influence Canadian home prices in the coming years:

Government Interventions

Various levels of government in Canada have introduced measures to cool the housing market, from foreign buyer taxes to stricter mortgage lending criteria. The impact of these measures will play a role in future pricing.

Economic Factors

Economic conditions, including interest rates, employment levels, and overall economic growth, will continue to influence housing demand and prices.

Demographic Shifts

As baby boomers retire and downsize, and younger generations enter the housing market, demographic shifts will play a role in shaping demand and prices.

FAQs

How does the Canadian housing market compare to other countries?

While Canada’s housing market is notably expensive, especially in urban centers, other countries like Australia and New Zealand also face high housing prices due to similar factors like limited land for development and foreign investment.

How do property taxes influence housing prices in Canada?

Property taxes can vary by province and municipality. Higher property taxes can deter some buyers, but they’re typically a secondary consideration after factors like location and home size.

Are there affordable housing programs in Canada?

Yes, both federal and provincial governments offer various affordable housing programs and initiatives to assist first-time homebuyers and those in the low-income bracket.

How does the Canadian banking system impact housing prices?

Canada’s conservative banking practices, including stringent mortgage qualification criteria, have contributed to a more stable housing market, preventing the kind of crash seen in places like the US in 2008.

Are there regions in Canada where housing is still relatively affordable?

Yes, while cities like Toronto and Vancouver are notably expensive, other areas, especially in the Atlantic provinces and parts of the Prairies, offer more affordable housing options.

Final Words

The Canadian housing market, with its soaring prices, has been a topic of intrigue and concern for many. While various factors contribute to the high costs, understanding them can empower potential buyers to make informed decisions. As the market continues to evolve, staying informed