California, the Land of Dreams, is recognized for its spectacular coastal views, delicious and fresh food, as well as booming industries in Silicon Valley and Hollywood. However, living in California comes with a high price tag.

If you’re unaware of the soaring property prices in the Golden State, bear in mind that living expenses, including essential commodities and housing, are on the higher end.

But don’t lose heart. We present a list of eight Californian cities where home prices have seen a substantial decline. These cities could potentially be your next home in this diverse West Coast state.

San Francisco

- Sept. Median Sale Price: $1,196,667

- 3-month change in price: negative-$188,333

- 3-month change in price: negative-15.74%

San Francisco, the city on the shores, has something for everyone, from dog parks to tech or start-ups. However, the rental costs here are sky-high.

Despite the 101% rise in rent in 2021, San Francisco continues to attract young professionals, making it an excellent place to kickstart your career and own a home simultaneously.

San Jose

- Sept. Median Sale Price: $1,480,000

- 3-month change in price: negative-$173,833

- 3-month change in price: negative-11.75%

South of San Francisco, in the heart of Silicon Valley, lies San Jose, surrounded by mountains, beaches, and plenty of nature and wildlife.

It’s the modern gold rush city, with the highest concentration of wealthy individuals globally: one in every 727 residents has a net worth of $30 million, as per the 2021 Wealth-X World Ultra Wealth Report. Now is a great time to move here, with the housing market as pleasant as the city’s weather.

Stockton

- Sept. Median Sale Price: $518,333

- 3-month change in price: negative-$41,667

- 3-month change in price: negative-8.04%

Stockton may lack the cultural allure of its counterparts, but it’s an excellent place to purchase a home and settle. Nestled in the Central Valley, its housing prices are about a third of San Francisco’s.

An agricultural hub, it’s a short drive from The Bay Area, and it houses The Haggins Museum, Bob Hope Theatre, and University Park World Peace Rose Garden.

Los Angeles

- Sept. Median Sale Price: $901,333

- 3-month change in price: negative-$63,667

- 3-month change in price: negative-7.06%

Welcome to Los Angeles! The renowned City of Angels has seen a decrease in housing prices, making it a more affordable place to pursue your dreams.

Beyond the Hollywood glitz, Los Angeles is a food paradise, offering some of the best and most diverse dishes worldwide.

San Diego

- Sept. Median Sale Price: $853,333

- 3-month change in price: negative-$55,000

- 3-month change in price: negative-6.45%

Looking for a classy place to call home? San Diego is available at a reasonable price. Known for its beaches and sunny weather, this “America’s Finest City” is also an educational hub, hosting several top-ranked institutions.

Oxnard

- Sept. Median Sale Price: $818,333

- 3-month change in price: negative-$50,000

- 3-month change in price: negative-6.11%

Oxnard, though less known, is an excellent choice for your next home. With access to outdoor activities and proximity to Ventura and Simi Valley, and just an hour drive from Los Angeles, it’s an ideal suburban getaway.

Sacramento

- Sept. Median Sale Price: $572,833

- 3-month change in price: negative-$30,500

- 3-month change in price: negative-5.32%

Sacramento, the capital city, is currently a lucrative place to invest in a home. With approximately 18,000 job vacancies and a thriving economy, Sacramento’s appeal goes beyond politics.

The city’s transportation is quite manageable, and savings on living expenses can be used for a quick getaway to Lake Tahoe or a flight from the international airport.

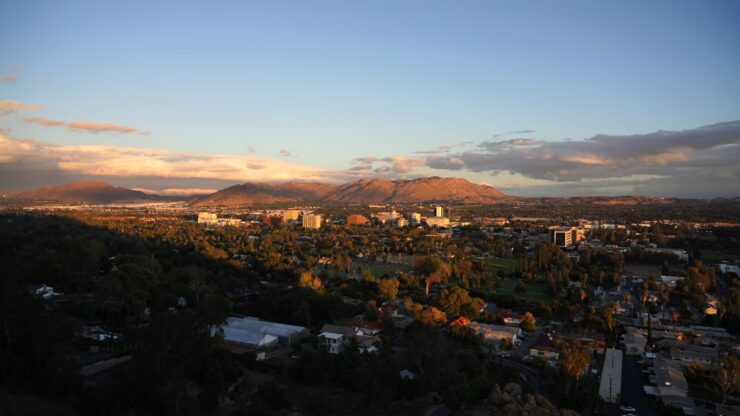

Riverside

- Sept. Median Sale Price: $545,000

- 3-month change in price: negative-$25,333

- 3-month change in price: negative-4.65%

Situated midway between Los Angeles and San Diego, Riverside is a promising spot for homebuyers. While LA might be known for films and TV, Riverside boasts a vibrant art scene.

Be sure to visit Fox Performing Arts Center, Riverside Municipal Auditorium and Events Center, Riverside Art Museum, Mission Inn Museum, and Riverside Metropolitan Museum.

Approach

For this analysis, We utilized data from Zillow regarding the median sale prices of homes in California as of September 2022 to identify areas where property prices are declining most significantly.

The analysis was initially restricted to the largest metropolitan areas in California. Then, the median sale prices for both June 2022 and September 2022 were identified for each area.

This enabled Us to calculate the numerical difference in median sale prices over the three-month period and the percentage change over the same period. However, only one factor was considered in establishing rankings. All data was gathered and verified as of November 28, 2022.

FAQ

How does the cost of owning a home in the Bay Area compare to renting?

Owning a home in the Bay Area now costs more than twice as much as renting one, making it the largest disparity of any major population center in the U.S.

This is due to the high competition for homes amid a severe shortage, which has driven the median single-family house price to $1.25 million, a 28% increase over the past three years. Additionally, average mortgage rates have doubled to more than 6%, significantly increasing monthly payments.

What is the situation in other major U.S. cities?

According to a report by Redfin, it’s cheaper to own than to rent in only four major U.S. cities: Detroit, Philadelphia, Cleveland, and Houston.

These cities have seen stagnant home values compared to the rest of the U.S. After the Bay Area, the cities with the largest gap between homeownership and rental costs are Anaheim, Seattle, Los Angeles, and San Diego.

How has the pandemic affected the cost of homeownership in once-affordable cities?

The pandemic has led to a significant increase in remote work, causing many workers to move to once-affordable cities. This has resulted in a significant rise in the cost of homeownership in these areas.

For example, it now costs 54% more to own a home in Sacramento, 35% more in Las Vegas, and 25% more in Phoenix.

What are some of the concerns for potential homeowners in the Bay Area?

In addition to the high cost of mortgages and down payments, potential homeowners in the Bay Area are concerned about the costs of property upkeep and the challenges of securing homeowners insurance, especially in fire-prone areas.

For instance, State Farm and Allstate, two of the largest insurance providers, have recently stopped writing new policies in California due to wildfire concerns.

What is the future outlook for homeownership affordability?

The main way homeownership could become more affordable is if mortgage rates start to fall. This could happen if the Federal Reserve lowers the cost of borrowing throughout the economy in its fight against inflation.

However, the California Association of Realtors expects rates to stay high for the rest of the year as inflation remains above the Fed’s target range, which will continue to put pressure on affordability in the coming quarters.