In today’s article, we are going to talk about TransUnion vs. Equifax, a.k.a. the two major credit bureaus, and the difference between them. This topic is very important, especially if you wonder why you sometimes notice slightly different numbers when you read your credit reports, and we will look to reveal some unclear facts about it.

For starters, when you pull your Equifax and TransUnion credit reports, you will notice that the credit scores may vary. In order to help you get a better understanding of the variation in these scores, we will point out some main distinctions between Equifax and TransUnion calculating algorithms and break down both to paint you a better picture of what each represents. We have a lot to cover, so let us begin without further ado.

What Exactly Are Credit Scores?

Credit scores are numbers that lenders use to determine the level of risk linked with lending money to their consumers. These scores are based on a consumer’s credit report, and everyone has more than one credit score since they are calculated by three main credit reporting agencies – TransUnion, Equifax, and Experian.

Some lenders opt to use internal scoring models too, but generally speaking, it is more common to work with lenders using the scores of one of these three credit reporting agencies. A credit report provides information about a consumer’s financial standing, such as:

- Payment history

- Outstanding balances

- Length of credit history

- Applications for new credit accounts

- Types of credit accounts

It is also important to mention that credit reports from each of the three major credit bureaus can be accessed annually, and this information is completely free of charge for every consumer.

Why Are My Credit Scores Different?

TransUnion and Equifax are alongside Experian, the biggest credit bureaus, and they maintain databases that contain information about over 220 million Americans. As we previously said, your credit score is not the same in every credit bureau.

Equifax and TransUnion rely on the same factors to come up with the credit scores, but these factors are evaluated via different credit-scoring methods, which makes the biggest difference between these two companies and how they provide the final scores.

The major credit bureaus also do not get the same information from lenders and creditors, so this is another reason why the scores can vary sometimes. Another essential thing to note is that some lenders and creditors solely focus on scores that emphasize the info relevant to a particular industry, while others opt for blending TransUnion, Equifax, and Experian scores.

To put everything in simple terms, we singled out three main reasons why your credit scores from TransUnion and Equifax can differentiate.

1. Credit-scoring Models Are Different

All credit-scoring agencies, including TransUnion and Equifax, use proprietary scoring models, and despite the fact that credit scores are based on similar or the same factors, such as payment history and the number of accounts in good standing, each model can weigh some of these factors in a different way.

2. The Credit Bureaus May Possess Different Information

The credit-reporting companies may not possess all the information about you since some lenders might report information to all major credit bureaus, while others may do it to only one or two. It is also important to note that lenders might send their reports at different periods of time, so it is possible that TransUnion might have fresher updates than Equifax and vice versa.

3. You Might Have Scores From Different Dates

A credit score is no more than a snapshot of your credit profile at one point in time. Due to the fact that credit scores can change over the course of time, it is essential to compare scores from the same period when comparing them with other credit bureaus.

TransUnion vs. Equifax: How Are Scoring Models Calculated

As we previously highlighted, TransUnion and Equifax calculate their scoring models in different manners, but they also assess the scores differently. In the section below, we broke down how each bureau goes through this process in detail.

TransUnion’s Vantage Score Scoring Model

| Payment History | 40 percent |

| Length and Type of Credit | 21 percent |

| Credit Utilization | 20 percent |

| Total Credit Balance | 11 percent |

| Recent Credit Behavior | 5 percent |

| Available Credit | 3 percent |

Scores Assessment

| Very Poor | 300 – 499 |

| Poor | 500 – 600 |

| Fair | 601 – 660 |

| Good | 661 – 780 |

| Excellent | 781 – 850 |

Equifax’s Scoring Model

| Payment History | 35 percent |

| Credit Utilization | 30 percent |

| Credit History | 15 percent |

| Credit Mix | 10 percent |

| New Credit Accounts | 10 percent |

Scores Assessment

| Poor | 280 – 559 |

| Fair | 560 – 659 |

| Good | 660 – 724 |

| Very Good | 725 – 759 |

| Excellent | 760 – 850 |

What Information Are Necessary for Calculating Credit Scores?

Both TransUnion and Equifax require a range of metrics to make their calculations of credit scores. We made a list of essential data points these bureaus require to make their calculations of your credit scores.

1. Credit History

Credit reporting agencies need to assess your overall credit history when they need to make the calculation of your score. They will typically have a look at your defaulted payments, an overabundance of loans, and pretty much any other sign that can signalize the potential financial risk.

2. Rate of Credit Usage

The rate of credit usage refers to the amount of revolving credit you use, and it is essential in these calculations. It is the amount of credit you have used from credit cards and other lines of credit.

To put it in simpler terms, the higher percentage of your used credit to available credit, the worse it will reflect on your score. Generally speaking, it is best to keep your credit usage rate lower than thirty percent if you want to keep your credit score strong.

3. Payment History

On-time payments are one of the crucial aspects that keep your credit score in good condition. If you miss your payments or you are late with them, your credit score will rapidly decrease, which will impact your ability to access credits.

4. Credit Inquiries

Whenever you want to apply for a loan, credit card, or any other type of service that requires credit inquiries, they will automatically appear on your credit report. It is a piece of information essential for lenders to know whether or not you routinely access the credit. The more recent inquiries there are in your history, the worse your credit score gets.

However, these inquiries remain on your credit report for two years and will only have a significant impact throughout the first year.

5. Public Records

Public records can create a lot of damage to your credit file, especially if the lender is suing you for defaulting on a loan, a bankruptcy filing in court, or any negative filing. Keeping these records in check is very important since inconsistencies and incorrect records can be a sign of identity fraud.

This is especially important if someone steals your identity, applies for credit in your name, and defaults on payments, which will eventually result in incorrect public records that may appear on your credit report.

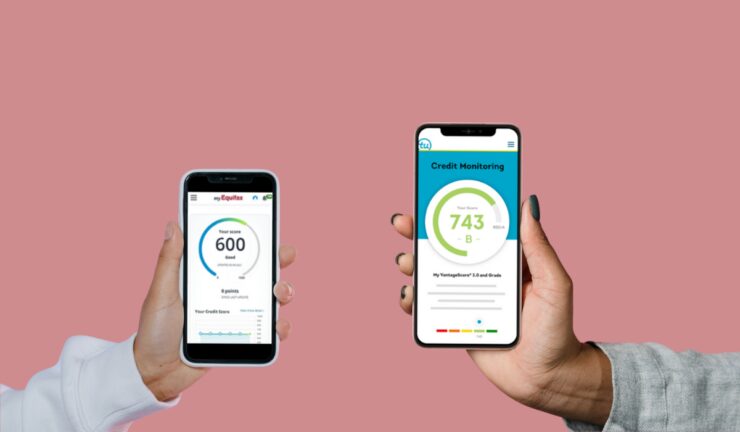

TransUnion vs. Equifax: Which Is More Accurate?

The first thing that is important to mention regarding this topic is that credit scores are complied with using different scoring systems, which are automatically subjective by their nature. Equifax uses a scoring model similar to the FICO, while TransUnion uses VantageScore, and both models are subjective, as well as “educational” models used by credit bureaus.

The thing that is certain is that if you are looking for the scores the lenders will most likely use to assess whether to provide you with loans or lines of credit or not, the better choice in most cases is FICO.

With that said, the scores provided by TransUnion and Equifax will not be much different from what you will find with FICO, and if you are looking for a ballpark figure, both will provide you with satisfying results.

Which Credit Score Do Lenders Generally Use?

As the Consumer Financial Protection Bureau clearly stated, the scores that TransUnion and Equifax provide are not something that lenders commonly use, and they rarely turn to them. These scores are considered “educational credit scores”, thus, they are intended for consumers for educational use and purposes.

Aside from that, you can find info on Equifax’s official site that clearly states that lenders will not use their scores in assessing their customers’ creditworthiness, as they are intended to provide consumers to paint them a better picture of where they stand credit-wise.

Judging by the various reliable sources, 90 percent of United States lenders use FICO scores when they want to check consumer credit and make a lending decision. The FICO 8 is the model that is most commonly used by credit card companies for this purpose, but Vantage Score also finds its uses with some companies.

It is also important to mention that there is more than just one FICO score, and depending on what type of credit you want, lenders may decide to evaluate your credit risk using different FICO score versions. For example, credit card issuers will likely use FICO 8 or FICO Bankcard scores, but if you want an auto loan, it is likely that lenders will use FICO Auto Scores.

TransUnion vs. Equifax: What Do They Offer With Credit Scoring and Reports?

Aside from credit scoring and reports, these credit agencies have a set of unique offerings that are created to help consumers get a better understanding of their credit and to provide them protection against fraud and anything that can harm them financially.

TransUnion membership costs 24.95 USD on a monthly basis, and all the members gain unlimited access to credit scores and reports that get updated every day. They also get recommendations and advice to help improve the members’ credit scores, and finally, all the members get TransUnion’s product, Credit Lock Plus, which allows every individual to lock their TransUnion report.

On the other hand, we have Equifax, where signing up costs 9.95 USD on a monthly basis, and all members get credit report monitoring, daily access to VantageScore credit score, which we mentioned earlier, daily ID restoration specialist that helps members recover from identity theft, and lastly, up to 500.000 in identity theft insurance.

As you can see, both bureaus offer similar benefits and services to their members, so opting for either of these will certainly get the job done. However, if one of your primary concerns is to stay safe and secure from hazards such as identity theft, it is better to go for Equifax.

How the Credit Bureaus Get Your Info

In case you do not recall giving permission to the credit bureau permission to create a credit file about you, it is probably true, but that is not how the bureaus work. They usually open these files by acquiring details from the companies you owe the money and they willingly share this information with the bureaus.

Companies such as lenders, banks, credit card issuers, collection agencies, and similar will always share these details with bureaus. They do so for a variety of reasons, one of the biggest ones being that it gives extra motivation for the company’s customers to pay their debts fully and on time.

Nevertheless, the important thing to have in mind is that credit bureaus absolutely must follow federal and state laws. With that said, when you get frustrated about the fact that credit bureaus are allowed to collect sensitive financial information without your permission, you should also be aware that there are rules in place that will protect you.

On the feral level, bureaus must follow the Fair Credit Reporting Act, which is there to protect consumers and regulate what consumer reporting agencies are required to do when it comes to your information. It is something that protects you, and this is an act that is 100 pages long, so we strongly advise that you take some time and read it thoroughly.

Frequently Asked Questions

1. Why do scores from TransUnion and Equifax can differ?

These scores can differ since these bureaus can use different algorithms and they may have access to different information. Due to these circumstances, potential errors may occur in reporting.

2. What actions should I take if I notice an error in my credit report?

The first thing you should do is contact your credit issuer to resolve the problem. You can also initiate a dispute with either TransUnion or Equifax, depending on which services you use.

3. Can I check my credit score for free?

Both TransUnion and Equifax allow you to check your credit score annually, and this service is provided for free by both bureaus. You can also take advantage of free services such as Borrowell and Credit Karma.

It is also important to mention that Borrowell gets its credit scores from Equifax, while Credit Karma gets their scores from TransUnion.

4. Is Equifax more accurate than TransUnion?

Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Closing Thoughts

In terms of accuracy and reliability, both TransUnion and Equifax will do their job and provide precise information; the only difference between them is that they use different algorithms to generate credit reports.

With that said, when you notice the different numbers from TransUnion and Equifax, it just means they have used different methods to calculate them and that your score is still very accurate. If your credit score is 600, check out some of the best credit cards you can get for it in our detailed and comprehensive article.

We update our content regarding finances on a daily basis, so feel free to revisit us and stay up to date with fresh information and news.