The Rothschild family’s legacy in finance and philanthropy is long-established, with their influence spanning centuries and continents.

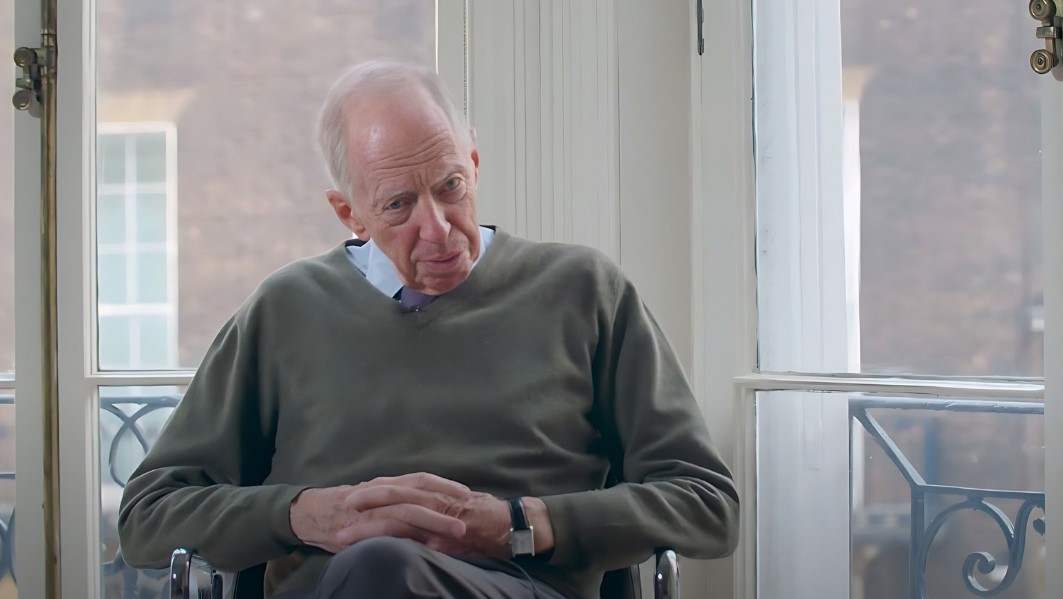

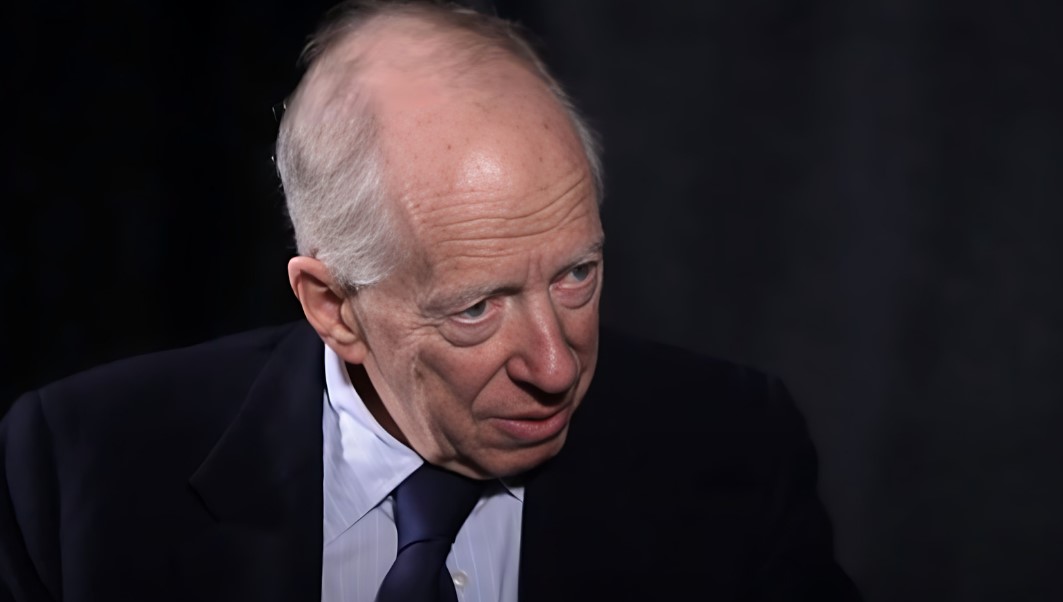

In 2024, this historic lineage draws attention once again due to the passing of Lord Jacob Rothschild at 87, an event that has sparked discussions on the current net worth of the Rothschild family and the stature of their financial empire.

The passing of Lord Jacob Rothschild marks a poignant moment for the family estate, signaling potential changes in the structure and management of their holdings. This event also rekindles interest in the family’s net worth, which is a frequently discussed topic proliferating with speculation and intrigue in financial circles and media.

Key Takeaways

- The Rothschild family’s 2024 net worth estimated at $400 billion to $20 trillion.

- Lord Jacob Rothschild, a key figure, passed away at 87.

- Wealth spans various sectors, including finance, real estate, and philanthropy.

- Jacob Rothschild’s departure from N.M. Rothschild & Sons in 1980.

- Legacy includes significant contributions to arts, culture, and charity.

- Their fortune, rooted in 18th-century banking, has diversified into multiple sectors globally.

- The Rothschild wealth and influence are unparalleled, exceeding that of other historic financial dynasties.

Rothschild Family Net Worth in 2024

The Rothschild family is synonymous with wealth and banking, with a legacy spanning centuries. In 2024, their fortune remains a topic of interest and speculation. The legacy of the Rothschild family’s wealth is difficult to quantify accurately, as it is dispersed among various family members and entities. However, it is clear that their financial impact remains significant.

As of 2024, according to Celebrity Net Worth the Rothschild family’s net worth is around 400 billion US dollars. This figure emerges following the recent passing of Lord Jacob Rothschild, a notable member of the family. However, according to some sources say that they are worth over $20 Trillion dollars.

Wealth Distribution:

- Although precise figures are challenging to determine, the family’s wealth is understood to be divided among several heirs and branches.

- Investments and holdings are spread across industries and countries, reflecting the Rothschild’s historical diversity in financial affairs.

Their fortune has historically encompassed various sectors, including financial services, real estate, and wine production. The family’s financial operations are vast, with connections to many different business sectors and regions. Notably, RIT Capital Partners, established by Jacob Rothschild, is an investment vehicle which has contributed to the family’s wealth.

Significant to recent events, Lord Jacob Rothschild’s death has brought attention to the heirs of his estate. His daughter, Hannah Rothschild, remains an influential figure within the financial legacy, overseeing a substantial stake in the investment firm.

Lord Jacobs’ Death

Jacob Rothschild, a renowned banker and philanthropist, has passed away at the age of 87, according to an announcement from his family provided to the Press Association. The cause of his death was not disclosed.

“Our father Jacob was a towering presence in many peoples’ lives – a superbly accomplished financier, a champion of the arts and culture, a devoted public servant, a passionate supporter of charitable causes in Israel and Jewish culture, a keen environmentalist and much-loved friend, father and grandfather.”

the family said in the statement.

Rothschild made a significant career move in 1980 when he left N.M. Rothschild & Sons Ltd. to concentrate on the Rothschild Investment Trust, stepping away from the family business due to disagreements over its future direction according to the Fortune. This venture, which has since been rebranded as RIT Capital Partners Plc, has grown into one of the largest investment trusts in the UK.

In addition to his work with RIT, Rothschild helped to establish St. James’s Place Plc, an asset management firm, and was involved in a notable but ultimately unsuccessful attempt to take over British American Tobacco Plc in a deal valued at $21 billion, three decades ago.

Recognized as one of the UK’s leading philanthropists, Rothschild led the National Gallery and the National Heritage Lottery Fund’s boards according to the Art Newspaper. He was an avid art collector who undertook the restoration of Spencer House in London and led the extensive five-year renovation of Waddesdon Manor, a 19th-century estate built by one of his ancestors, from 1990 to 1995.

It was estimated that Jacob Rothschild, the 4th Baron Rothschild, was worth $5 billion; he is the father of the similarly affluent Nathaniel.

Who Was He?

Born in Berkshire, Lord Jacob Rothschild was educated at Eton College and went on to study history at Christ Church College, Oxford University. He was a prominent figure in the finance world, leading RIT Capital Partners, a major investment trust on the London Stock Exchange, as its chairman until 2019.

His career also included roles such as deputy chairman of BSkyB Television, director of RHJ International (later known as BHF Kleinwort Benson Group), and a member of the Duchy of Cornwall council for the then-Prince of Wales.

Rothschild also founded Windmill Hill Asset Management to oversee his family’s charitable assets and chaired the trustees for The Rothschild Foundation charity, further showcasing his commitment to philanthropy and the arts.

Financial Empire

The financial saga of the family began in the 18th century when Mayer Amschel Rothschild founded a banking business in Frankfurt according to Oxford Reference. Over time, his five sons expanded the family’s banking endeavors across Europe, establishing branches in major cities such as London, Paris, Vienna, and Naples.

Their innovative methods in banking and finance notably included the development of an international network for financial transactions. This growth allowed the Rothschilds to amass significant wealth and become synonymous with international banking power.

Current Investments and Assets

The family is known to manage a diverse portfolio through their holding company, E.L. Rothschild, which was until recently overseen by Lynn Forester de Rothschild. Their investments span various sectors, including financial services, agriculture, and real estate. They maintain a substantial collection of artworks, and their involvement in winemaking continues through the ownership of esteemed vineyards.

Nathan Rothschild: Architect of International Finance

Among Mayer’s sons, Nathan Rothschild emerged as the most illustrious, steering the family’s banking enterprise to unprecedented heights. His innovative use of carrier pigeons for rapid communication and his ventures into international finance, including investments in infrastructure and banking services, solidified as pivotal players in Europe’s economic landscape as highlighted by Forbes.

Nathan’s move to England and the establishment of N M Rothschild & Sons Limited underscored the family’s enduring legacy in banking, with the firm reporting significant profits and continuing operations as one of the oldest banks in the UK.

Milestones in Their History

- 1763: Mayer Amschel Rothschild joins the family business.

- 1769: Mayer receives the title of ‘Court factor’ from Prince Wilhelm.

- 1789: Nathan Rothschild initiates a textile venture in Manchester.

- 1810: Nathan sets up N M Rothschild in London.

- 1824: Alliance Assurance Company is founded by Nathan and Moses Montefiore.

- 1835: Nathan secures rights to mercury mines in Spain.

- 2019: N M Rothschild and Sons announces revenues of €1.87 billion.

Comparison of the Rothschild Wealth to Other Financial Dynasties

The Rothschild family, with an estimated net worth of around $400 billion in 2024, stands as a towering figure in the landscape of global wealth. This figure places them among the top echelons of wealth, comparable to some of the wealthiest families in the world. In comparison, the Rockefeller family, one of America’s historic financial dynasties, reportedly has a net worth that is significantly lower than that of the Rothschilds.

Here is a brief comparison between the Rothschild wealth and other notable dynasties:

| Financial Dynasty | Estimated Net Worth |

|---|---|

| Rothschild Family | $400 billion |

| Rockefeller Family | $11 billion |

| Walton Family | $267 billion |

The Walton family, heirs to the Walmart fortune, are one of the few that surpass the Rothschild fortune, with an accumulated wealth of approximately $267 billion according to the Forbes. The Rothschilds’ lasting influence has been sustained through astute banking and investment practices, which span multiple continents and generations. Their wealth has become somewhat synonymous with enduring financial success.

Economic Influence

Family has been synonymous with international finance for centuries, amassing considerable wealth through their banking empire. Over time, their economic influence has shaped industries, governments, and even the course of national economies.

Their financial institutions have been pivotal in providing capital for government projects and commercial ventures across Europe, often acting as lenders of last resort during economic crises. With a reported collective net worth that has provided them with substantial economic clout, the family has been a critical player in major financial dealings.

- Investment Banking: The Rothschild banking legacy includes advising on some of the largest mergers and acquisitions.

- Philanthropy: They have established numerous charitable foundations.

One measure of their influence is noted in their assets under management, a considerable sum that underscores their standing within the financial sector. In recent years, specific figures mentioned range significantly, suggesting a net worth from an estimated $1 billion to assumptions directed towards the upper echelons of hundreds of billions, and trillions.

In the realm of private wealth management, the family maintains a distinguished reputation. Investment strategies and decisions made by their financial advisories hold the potential to direct vast amounts of capital, influencing market trends and investment flows globally. As a powerful financial dynasty, their legacy continues to impact the modern economic landscape.

Public Perception and Media Representations

They have also faced unfounded conspiracy theories and antisemitic sentiments, which have painted them as shadowy figures with disproportionate control over global finances. These claims have been unequivocally refuted, but despite evidence to the contrary, such theories persist in some circles.

With such a multifaceted presence, the family’s depiction in media spans from respected financiers to controversial figures. This spectrum of representation influences how the public perceives them, blending factual historical impact with sometimes sensationalist narratives.

Philanthropy and Charitable Contributions

The Rothschild family has a longstanding history of philanthropy and charitable work, which has continued into the modern era. Key areas of interest for the family’s contributions have historically included arts, education, environmental conservation, and public health. They have supported a broad range of causes and institutions via direct contributions and through the work of various Rothschild foundations.

- Arts and Culture: Significant contributions have been made to the preservation of art, architecture, and historical heritage. The family has often provided backing for art galleries, museums, and restoration projects.

- Education: Scholarships and endowments to educational institutions have been a hallmark of their commitment to learning and academia.

- Environmental Conservation: The family has shown keen interest in environmental initiatives, championing efforts to conserve landscapes, wildlife, and even ventures into sustainable agriculture.

- Public Health: Investments in medical research and facilities aim to improve public health outcomes and contribute to advances in medical science.

Frequently Asked Questions

Final Words

The Rothschild family’s journey from Mayer Amschel Rothschild’s 18th-century foundation to its current status showcases a remarkable evolution of a financial dynasty. Their ascent during the 19th century was characterized by strategic banking operations and astute investments, cementing their status among Europe’s elite.

Despite the natural ebb in prominence over generations, the Rothschilds have adeptly managed their holdings, ensuring the family’s wealth and influence remain significant. Investments span diverse sectors, including banking, winemaking, mining, and real estate, reflecting a broad approach to asset management. This diversification, coupled with a commitment to philanthropy, underscores the enduring Rothschild legacy in global finance and beyond.

Disclaimer

All information presented in this text is based on our own perspectives and experiences. The content is provided for informational purposes only and is a reflection of the personal views of the authors. It should not be taken as professional advice, nor should it be used as a basis for making significant decisions without consulting a qualified expert. We do not guarantee the accuracy or reliability of the information provided and shall not be held responsible for any inaccuracy, omissions, or inaccuracies. We highly recommend consulting with a qualified expert in the relevant field for personalized guidance or advice specific to your situation.