Starting a business can be an exciting and rewarding journey, but it can also be a daunting task for those who are new to the world of entrepreneurship.

From developing a business idea to launching a product or service, there are many steps involved in starting a successful business. In this article, we will provide you with a step-by-step guide on how to start a business.

Step 1: Develop a Business Idea

The first step in developing a business idea is to identify your passion, skills, and interests. What are you good at? What do you enjoy doing? What problem can you solve? These questions will help you to narrow down your focus and identify potential business ideas that align with your strengths and interests.

Once you have identified potential business ideas, it is important to research your target market. Who are your potential customers? What are their needs and preferences? What solutions are currently available in the market? This information will help you to refine your business idea and determine its viability.

Don’t forget to conduct a SWOT analysis. This is a tool used to assess the strengths, weaknesses, opportunities, and threats of a business idea. This analysis will help you to identify potential obstacles and opportunities that may affect the success of your business. It is important to be honest and realistic in your assessment.

Before investing time and money into your business idea, it is important to validate it. This can be done by conducting surveys or focus groups to gather feedback from potential customers. You can also test your product or service in a small market to gauge its viability.

Step 2: Conduct Market Research

Once you have developed your business idea, it is important to conduct market research. This will help you to identify your target market, understand their needs and preferences, and determine the size of the market.

To conduct effective market research, start by identifying your research objectives. This will help you to focus your research and gather the most relevant information. Determine what you want to learn, whether it’s identifying customer needs and preferences, evaluating market trends, or assessing the competition.

Next, choose your research methods. There are many methods available, including surveys, focus groups, interviews, and online research. Each method has its advantages and disadvantages, so it’s important to choose the one that is best suited to your research objectives and budget.

Once you have chosen your research methods, it’s time to create your research instrument. This could be a survey questionnaire, interview guide, or focus group discussion guide. Make sure that your research instrument is clear, concise, and unbiased to ensure accurate and reliable data.

After collecting your data, it’s time to analyze it. This involves summarizing and interpreting the data to identify patterns, trends, and insights. It’s important to look beyond the numbers and consider the context of the data to understand its implications for your business.

Finally, use your research findings to make informed decisions about your business strategy. This could involve developing new products or services, targeting a new customer segment, or adjusting your marketing strategy. Remember to continuously monitor and evaluate your market research to stay up-to-date with industry trends and changes in customer needs and preferences.

Step 3: Write a Business Plan

A business plan is an essential document that outlines your business goals, strategies, and financial projections. It also includes information on your target market, competition, and marketing strategies. A well-written business plan will help you to secure funding and attract investors.

It provides a roadmap for your business and helps you to identify and overcome potential obstacles. Key elements of a business plan include an executive summary, company description, market analysis, products and services, marketing and sales strategies, and financial projections. When writing a business plan, it’s important to be clear, concise, and realistic, and to tailor the plan to your target audience.

Step 4: Secure Funding

Securing funding is an important step in starting a business. There are many funding options available, including loans, grants, and investments. It is important to research and compare these options to find the one that is best for your business.

This step is important for several reasons. First, it provides the financial resources necessary to launch and grow your business. This can include covering startup costs, purchasing equipment or inventory, and paying for marketing and advertising expenses. Without adequate funding, your business may not be able to get off the ground or reach its full potential.

Second, securing funding can help you to attract investors and lenders. Investors and lenders want to see that your business has a solid financial foundation and a clear plan for growth. By securing funding, you can demonstrate your commitment to your business and your ability to manage financial resources effectively.

Third, securing funding can help you to mitigate risk. Starting a business involves taking risks, but securing funding can help you to minimize those risks by providing a financial cushion. This can help you to weather any unexpected expenses or setbacks and keep your business running smoothly.

Step 5: Choose a Business Structure

Choosing a business structure is an important decision that will affect your business operations, taxes, and liability. The most common business structures are sole proprietorship, partnership, LLC, and corporation. It is important to consult with a legal and financial expert to determine the best structure for your business.

Here are some key factors to consider when choosing a business structure:

Liability

One of the most important factors to consider is a liability. The business structure you choose will determine your personal liability for business debts and obligations. For example, a sole proprietorship and partnership have unlimited personal liability, while an LLC and corporation offer limited liability protection.

Taxes

The business structure you choose will also affect your taxes. Sole proprietorships and partnerships are pass-through entities, which means that business income and expenses are reported on the owner’s personal tax return. LLCs and corporations, on the other hand, are separate tax entities and are taxed separately from the owners.

Management and Control

The business structure you choose will also affect how your business is managed and controlled. Sole proprietors and partners have full control over the business, while LLCs and corporations have a more formal management structure.

Ownership and Transferability

The business structure you choose will also affect ownership and transferability. Sole proprietorships and partnerships are owned by one or more individuals, while LLCs and corporations can have multiple owners and can issue stock.

Types of Business Structures

Here are some of the most common business structures:

- Sole Proprietorship: A sole proprietorship is a business owned and operated by one individual. It is the simplest and most common business structure, but also has unlimited personal liability.

- Partnership: A partnership is a business owned and operated by two or more individuals. It is similar to a sole proprietorship, but with shared liability.

- Limited Liability Company (LLC): An LLC is a flexible business structure that provides limited liability protection for its owners. It combines the liability protection of a corporation with the tax benefits of a partnership.

- Corporation: A corporation is a separate legal entity owned by shareholders. It offers limited liability protection for its shareholders and has a formal management structure.

Choosing the right business structure is an important decision that requires careful consideration of your specific business needs and goals.

Step 6: Register Your Business

Once you have chosen a business structure, you will need to register your business. This includes obtaining a business license, registering for taxes, and obtaining any necessary permits or certifications.

Depending on your location, you may need to register your business with the government. This may involve filing articles of incorporation or articles of organization with the state or province. You may also need to obtain a tax identification number and any necessary licenses or permits.

As a business owner, you will be responsible for paying taxes on your business income. You may need to register for federal, state, and local taxes. This may include obtaining a sales tax permit, employer identification number, and business tax registration.

Depending on your industry and location, you may need to obtain additional licenses and permits to operate your business legally. This may include zoning permits, health and safety permits, and professional licenses.

If your business involves intellectual property, such as trademarks or patents, you may need to register them with the appropriate government agency. This will help to protect your rights to your intellectual property.

Federal Licenses and Permits

Federal licenses and permits are required for certain business activities that are regulated by the federal government. These licenses and permits are typically issued by federal agencies and are necessary to ensure compliance with federal laws and regulations.

| Business Activity | Description | Issuing Agency |

|---|---|---|

| Alcohol and Tobacco | Manufacture, import, or sell alcohol and tobacco | Alcohol and Tobacco Tax and Trade Bureau (TTB) |

| Aviation | Operate aircraft or provide aviation services | Federal Aviation Administration (FAA) |

| FCC | Use radio frequency devices, such as radio or TV | Federal Communications Commission (FCC) |

| FDA | Manufacture, import, or distribute food, drugs, medical devices, or cosmetics | Food and Drug Administration (FDA) |

| OSHA | Handle hazardous materials or engage in high-risk activities, such as construction or manufacturing | Occupational Safety and Health Administration (OSHA) |

Step 7: Set Up Your Business Operations

Setting up your business operations involves creating a website, establishing a physical location (if applicable), and creating a system for managing your finances, inventory, and employees.

The first step in setting up your business operations is to establish your legal and financial infrastructure. This includes registering your business, obtaining necessary licenses and permits, opening a business bank account, and setting up accounting and bookkeeping systems.

The second step is to determine your business processes. This includes identifying the tasks and activities that need to be performed to achieve your business goals. It’s important to establish clear processes and procedures to ensure consistency and efficiency in your operations.

The next step is to establish your organizational structure. This includes determining the roles and responsibilities of your team members, developing job descriptions, and establishing a hierarchy of authority. It’s important to create a clear and well-defined organizational structure to ensure that everyone understands their roles and responsibilities.

Once you have established your organizational structure, you can start hiring and training employees. This includes developing an effective recruitment process, conducting interviews, and providing training and development opportunities to help your employees succeed.

Step 8: Launch Your Product or Service

Launching your product or service is an exciting and important step in growing your business. However, it can also be a challenging process that requires careful planning and execution.

First, develop your launch strategy. This should include setting clear goals and objectives, creating a timeline, and determining the resources and budget required. Your launch strategy should also include a marketing plan that identifies the channels and tactics you will use to promote your product or service.

Once you have developed your launch strategy, you can start creating your marketing materials. This includes developing your branding, designing your packaging or website, and creating content such as social media posts, blog articles, and videos.

The final step is to launch your product or service. This includes making it available for purchase or use, and promoting it through your marketing channels. It’s important to monitor your launch closely and make any necessary adjustments to your strategy based on customer feedback. A successful product launch is just the beginning of the product life cycle, which includes several stages from development to decline.

Step 9: Monitor and Evaluate Your Business

Monitoring and evaluating your business is important to ensure that it is successful and sustainable. This involves tracking your financial performance, customer feedback, and market trends to make necessary adjustments and improvements.

Quick Tips

Here are some tips for monitoring and evaluating your business effectively:

- Set clear goals and objectives: To monitor and evaluate your business effectively, you need to have clear goals and objectives in place. These should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Use Key performance indicators (KPIs): KPIs are metrics that allow you to track your progress toward your business goals. By using KPIs, you can quickly identify areas where you may be falling short and make adjustments to your strategy.

- Regularly review your financial performance: Your financial performance is a key indicator of your business health. It’s important to regularly review your financial statements, such as your income statement and balance sheet, to identify trends and areas for improvement.

- Solicit customer feedback: Your customers are a valuable source of information about your business. Solicit their feedback regularly through surveys, reviews, and other methods to identify areas where you can improve your products or services.

- Stay up-to-date on market trends: Keeping up-to-date on market trends can help you to identify new opportunities for growth and expansion. Monitor industry publications, attend conferences and trade shows, and network with industry contacts to stay informed.

How to Write a Business Plan?

A business plan is an essential document that outlines your business goals, strategies, and financial projections. It provides a roadmap for your business and helps you to identify and overcome potential obstacles. In this section, we will discuss the key elements of a business plan and provide tips for writing a successful plan.

Executive Summary

The executive summary is the first section of your business plan and provides an overview of your business. It should include a brief description of your business, your target market, and your unique selling proposition. It should also summarize your financial projections and any funding needs.

Company Description

The company description provides more detailed information about your business. It should include information about your business structure, mission statement, and key team members. This section should also describe your industry and target market, as well as your competitive advantage.

Market Analysis

The market analysis section provides information about your target market and competitors. It should include information about your target customer, their needs and preferences, and any trends or changes in the market. This section should also include an analysis of your competition, including their strengths and weaknesses.

Products and Services

The products and services section describes what you offer to your customers. It should include a detailed description of your products or services, as well as any patents or trademarks you hold. This section should also describe your production process and any suppliers or vendors you work with.

Marketing and Sales Strategies

The marketing and sales strategies section describes how you plan to reach your target market and promote your business. It should include information about your pricing strategy, distribution channels, and advertising and promotion plans. This section should also include a sales forecast and any customer acquisition costs.

Financial Projections

The financial projections section provides an overview of your expected revenue and expenses. It should include a balance sheet, income statement, and cash flow statement. This section should also include an analysis of your breakeven point and any funding needs.

Writing Tips

When writing a business plan, it’s important to be clear, concise, and realistic. Your plan should be tailored to your target audience, whether it’s investors, lenders, or internal stakeholders. Here are some tips to help you write a successful plan:

- Use clear and concise language

- Avoid jargon and technical terms

- Include supporting data and research

- Be realistic and conservative in your financial projections

- Revise and update your plan regularly

Writing a business plan is an important step in starting and growing a successful business. It provides a roadmap for your business and helps you to identify and overcome potential obstacles. By including the key elements and following these writing tips, you can create a successful business plan that will help you to achieve your goals.

Check out some examples of well-written business plans.

Tips for Securing Funding

Here are some tips for finding the right funding sources for your business:

- Determine your funding needs: Before seeking funding, determine how much money you need and how you plan to use it. This will help you to identify the right funding sources and make a strong case for why you need the funding.

- Research funding sources: There are many funding sources available, including loans, grants, and investments. Research and compare these options to find the one that is best for your business.

- Prepare a strong business plan: A well-written business plan is essential for securing funding. It should include detailed financial projections and a clear plan for growth.

- Build relationships with investors and lenders: Building relationships with potential investors and lenders can help you to secure funding and build credibility. Attend networking events, reach out to industry contacts, and use social media to connect with potential funding sources.

- Be prepared to negotiate: When seeking funding, be prepared to negotiate the terms of the funding agreement. This includes interest rates, repayment terms, and equity stakes.

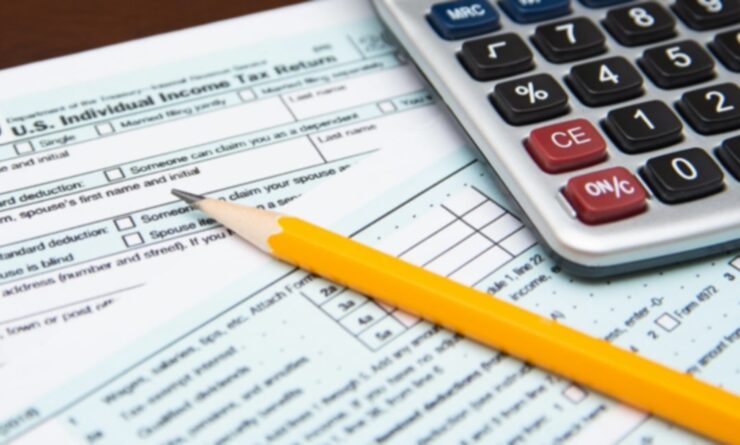

How to Get a Federal Tax ID Number

Getting a federal tax ID number, also known as an Employer Identification Number (EIN), is a necessary step for many businesses. An EIN is used to identify a business entity for tax purposes and is required for certain business activities, such as hiring employees or opening a business bank account. In this guide, we will provide an overview of the steps involved in getting a federal tax ID number.

Step 1: Determine Your Eligibility

Before applying for an EIN, you need to determine whether your business is eligible. EINs are issued to businesses that have a valid tax reason for obtaining one, such as hiring employees or opening a business bank account.

Step 2: Apply for an EIN

The most common way to apply for an EIN is through the IRS website. The online application is free and can be completed in a few minutes. You can also apply by mail or fax by completing Form SS-4 and submitting it to the IRS. According to Googleonlinefax.com

Step 3: Provide Required Information

When applying for an EIN, you will need to provide certain information about your business, such as its legal name, mailing address, and type of entity. You will also need to provide your Social Security number or the Social Security number of a responsible party for the business.

Step 4: Receive Your EIN

Once your application is processed, you will receive your EIN. This typically takes a few business days if you apply online or by phone. If you apply by mail or fax, it may take several weeks.

Step 5: Use It

Once you have received your EIN, you can use it for various business activities, such as opening a business bank account, filing tax returns, and hiring employees.

Getting state tax ID number

Getting a state tax ID number is a necessary step for many businesses that operate in a specific state. The process for obtaining a state tax ID number, also known as a state employer identification number (SEIN), varies by state.

To get a SEIN, the first step is to contact your state’s tax agency to find out the specific requirements and procedures for obtaining a SEIN. You will need to provide certain information about your business, such as its legal name, mailing address, and type of entity.

Once your application is processed, you will receive your SEIN. You can use it for various business activities, such as filing state tax returns, hiring employees, and collecting sales tax.

By getting a state tax ID number, you can ensure that your business is operating legally and compliantly with state tax regulations.

State income and employment taxes for businesses

State income and employment taxes are important for businesses that operate in a specific state. State income taxes are levied on a business’s taxable income, while employment taxes are levied on the wages paid to employees. In this short guide, we will provide an overview of state income and employment taxes for businesses.

State Income Taxes

State income taxes vary by state and can range from zero to over 10% of a business’s taxable income. It’s important to understand the tax laws in your state and make sure that you are filing your state income tax returns and paying your taxes on time.

State Employment Taxes

State employment taxes include state unemployment insurance (SUI) taxes and state disability insurance (SDI) taxes. SUI taxes are used to fund unemployment benefits for workers who lose their jobs, while SDI taxes are used to fund disability benefits for workers who are unable to work due to an injury or illness.

Businesses are typically required to register with their state’s workforce agency and pay SUI taxes on a quarterly basis. SDI taxes may also be required in some states. It’s important to understand the tax laws in your state and make sure that you are filing your employment tax returns and paying your taxes on time.

FAQ

How do I start a small business with no money?

Starting a small business with no money can be a challenging but rewarding endeavor. To begin, you should identify a profitable niche in which you have skills and experience. Look for opportunities to solve problems or meet needs that are not being addressed by other businesses.

From there, create a simple business plan that outlines your goals, target market, products or services, and marketing strategy. This will help you stay focused and organized as you start your business.

To get your business off the ground without breaking the bank, take advantage of free resources such as social media, online marketplaces, and networking groups to promote your business and reach potential customers. Additionally, use low-cost marketing strategies such as email marketing, content marketing, and guerrilla marketing to reach your target market and build brand awareness.

Start your business on a small scale and reinvest profits to expand and grow over time. Look for opportunities to collaborate with other businesses, offer value-added services, and continuously improve your products or services. Finally, seek advice and support from other entrepreneurs, mentors, or business advisors who can offer guidance and feedback as you start and grow your business.

What 3 things make a business successful?

There are many factors that can contribute to the success of a business, but here are three key elements that are essential for any business to thrive:

1. Strong Value Proposition:

A strong value proposition is the foundation of a successful business. It means having a clear understanding of what sets your business apart from competitors and how it provides value to customers. A business with a strong value proposition is able to effectively communicate its unique selling points and deliver products or services that meet the needs and expectations of its target market.

2. Effective Management:

Effective management is critical for the success of any business. It means having a clear vision for the business, making informed decisions, and effectively allocating resources. Good management also involves creating a positive company culture, providing adequate training and support to employees, and fostering innovation and creativity.

3. Financial Stability:

Financial stability is another key element of a successful business. It means having a clear understanding of the financial aspects of the business, including cash flow, profit and loss, and financial projections. A financially stable business is able to manage expenses, maintain a healthy balance sheet, and make strategic investments that drive growth.

What is the best business structure?

Some common business structures include sole proprietorship, partnership, LLC, and corporation. Each structure has its own advantages and disadvantages in terms of liability, taxes, and management structure. It’s important to consider the unique needs of your business and seek professional advice from an attorney or accountant when choosing the best structure for your business.

What businesses can you start alone?

There are many businesses that can be started alone, without the need for a partner or team. Here are some examples:

- Freelance Writing, Design, or Programming: If you have skills in writing, design, or programming, you can start a freelance business and work with clients remotely.

- Virtual Assistant: As a virtual assistant, you can provide administrative or technical support to clients from your own home office.

- Consulting: If you have expertise in a particular field, you can start a consulting business and offer your services to clients who need your knowledge and advice.

- Online Retail: Starting an online retail business allows you to sell products directly to customers through an e-commerce platform.

- Personal Training or Coaching: If you have experience in fitness, nutrition, or life coaching, you can start a business offering personalized training or coaching services.

- Blogging or Podcasting: If you have a passion for writing or talking about a particular topic, you can start a blog or podcast and build an audience through content creation and marketing.

- Home Cleaning or Maintenance: Starting a home cleaning or maintenance business allows you to offer services to homeowners and businesses in your local area.

- Pet Care Services: If you love animals, you can start a business offering pet care services, such as dog walking, pet sitting, or grooming.

Do I need a business credit card?

While you don’t necessarily need a business credit card to run a business, having one can offer several benefits. A business credit card can help you separate your personal and business expenses, track your expenses for tax purposes, and build credit for your business. Additionally, many business credit cards offer rewards programs and other perks that can help you save money and earn cash back or travel rewards.

However, it’s important to use a business credit card responsibly and avoid accruing high levels of debt. Be sure to choose a card with a reasonable interest rate, read the terms and conditions carefully, and make timely payments to avoid late fees and negative impacts on your credit score. If used correctly, a business credit card can be a valuable tool for managing your business finances and achieving your financial goals.

How much does it cost to create a business?

The cost of creating a business can vary widely depending on the type of business, industry, location, and other factors. Some businesses can be started with very little money, while others require a significant upfront investment. Here are some of the costs you may need to consider when starting a business:

- Legal Fees: Depending on your business structure, you may need to pay for legal fees such as registering your business, creating contracts, and obtaining licenses and permits.

- Equipment and Supplies: You may need to purchase equipment, such as computers, tools, or vehicles, as well as supplies and inventory to start your business.

- Office Space and Utilities: If you need a physical location for your business, you will need to factor in the cost of rent or mortgage, utilities, and other expenses.

- Marketing and Advertising: You may need to spend money on marketing and advertising to promote your business and attract customers.

- Employee Costs: If you plan to hire employees, you will need to consider the cost of salaries, benefits, and payroll taxes.

The total cost of creating a business can range from a few thousand dollars to several hundred thousand dollars or more. It’s important to create a detailed business plan and budget to understand the specific costs associated with your business and plan accordingly.

Conclusion

In conclusion, starting a business is a challenging but rewarding endeavor. By following these steps, you can increase your chances of success and build a thriving business. Remember to stay focused, persistent, and open to learning and growth. Good luck on your entrepreneurial journey!