The gift tax, a federal imposition on the transfer of assets or property without an equivalent return, might seem daunting at first glance. However, a closer examination reveals that the majority of Americans will remain unaffected by this tax, thanks to several pivotal regulations set by the Internal Revenue Service (IRS).

If you’re contemplating a significant gift, consulting a financial advisor can provide clarity on potential tax implications.

Understanding the Gift Tax

The gift tax comes into play when an individual transfers money or property to someone other than their spouse or dependent. This tax can range from a starting rate of 18% and escalate to a staggering 40% for specific gift values.

Typically, the onus of paying this tax rests with the giver, not the recipient. While the recipient doesn’t face immediate tax repercussions, they might be liable for capital gains tax if they decide to sell the gifted property later on.

However, not all gifts fall under this tax umbrella. The following are exempt:

- Tuition and educational expenses

- Donations to charitable organizations

- Medical bills

- Contributions to political entities

- Gifts to spouses and dependents

The gift tax’s impact is minimized for most Americans due to two pivotal IRS regulations: the annual gift tax exclusion and the lifetime exemption.

Annual Gift Tax Exclusion

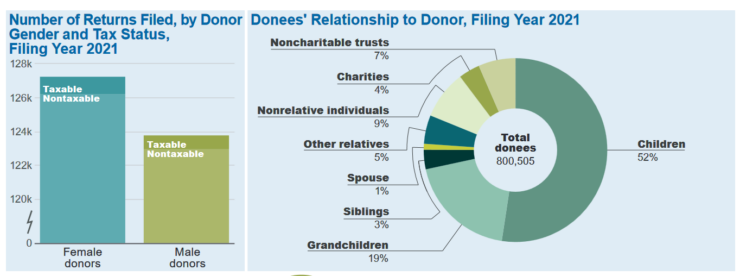

For 2024, the IRS permits individuals to gift up to $17,000 annually without any tax implications. To illustrate, an individual could distribute $17,000 to each of their 10 grandchildren in a year without incurring gift taxes. In 2022, this limit was set at $16,000.

However, if an individual opts to gift $21,000 to each grandchild, surpassing the annual limit by $4,000, they could be liable for taxes on the cumulative excess of $40,000. For married couples, each partner could gift $16,000 tax-free in 2022, enabling a couple like Cynthia and Joe to bestow up to $32,000 annually to each of their nieces and nephews.

Lifetime IRS Gift Tax Exemption

The 2024 regulations allow an individual to gift up to $12.92 million over their lifetime without triggering the gift tax. If a gift surpasses the annual limit, the excess is deducted from the individual’s lifetime exemption, ensuring no immediate taxes.

For instance, in 2024, if a grandmother gifts her granddaughter a car worth $30,000 for graduation, she would exceed the annual limit by $13,000.

However, by reporting this gift using IRS Form 709, she can deduct this amount from her $12.92 million lifetime exemption, leaving her with a balance of $12,079,000 for future tax-free gifts.

Deciphering the IRS Gift Tax Calculation

Only those with substantial assets to distribute are affected by the federal gift tax. The tax rates are marginal, similar to federal income tax, with the highest rate being 40%. Taxes are only applicable once the lifetime exemption is surpassed.

For gifts exceeding the annual exclusion ($16,000 in 2022 and $17,000 in 2024), the tax liability is determined using specific tax brackets. For instance, a gift of $34,000 would incur taxes of 18% on the initial $10,000, 20% on the subsequent $10,000, and 22% on the remaining $14,000, resulting in a total tax of approximately $6,900.

In Conclusion

While the intricacies of the federal gift tax are crucial for affluent individuals, the majority of Americans remain unaffected.

The IRS’s generous allowances of $16,000 in 2022 and $17,000 in 2024, along with lifetime exemptions of $12.06 million and $12.92 million respectively, ensure this.

However, for gifts exceeding the annual limit, it’s essential to file IRS Form 706 and report the gift.

Frequently Asked Questions (FAQ) on Gift Tax

- What is the gift tax?

- The gift tax is a federal tax imposed on the transfer of money or property to another individual without receiving an equivalent value in return.

- Who is responsible for paying the gift tax?

- Typically, the person giving the gift (the donor) is responsible for paying the gift tax. The recipient usually doesn’t have to pay any tax upon receiving the gift.

- Are all gifts taxable?

- No, certain gifts are exempt from this tax, such as tuition fees, charitable donations, medical expenses, political contributions, and gifts to spouses and dependents.

- What is the annual gift tax exclusion for 2024?

- For 2024, the annual gift tax exclusion is $17,000. This means an individual can gift up to $17,000 to any number of people in a year without incurring gift taxes.

- What was the annual gift tax exclusion for 2022?

- In 2022, the annual gift tax exclusion was $16,000.

- What happens if I exceed the annual gift tax exclusion?

- If you exceed the annual limit, the excess amount is deducted from your lifetime exemption. You won’t owe immediate taxes unless you surpass your lifetime exemption.

- What is the lifetime IRS gift tax exemption for 2024?

- For 2024, the IRS allows an individual to gift up to $12.92 million over their lifetime without incurring the gift tax.

- How is the gift tax calculated?

- The gift tax rates are marginal, similar to federal income tax. If you exceed your lifetime exemption, you’ll be taxed on gifts that surpass the annual exclusion based on specific tax brackets.

- Do recipients have to pay taxes on gifts?

- While recipients don’t face immediate tax consequences upon receiving a gift, they might be liable for capital gains tax if they sell the gifted property in the future.

- Do I need to report all gifts to the IRS?

- Only gifts that exceed the annual exclusion need to be reported using IRS Form 706.

- Are there any exceptions to the gift tax for married couples?

- Yes, each partner in a married couple can gift the annual exclusion amount tax-free. For example, in 2022, a couple could jointly gift up to $32,000 to an individual without tax implications.

- What if I gift someone a property? Is it taxable?

- The gift tax applies to both money and property. If the property’s value exceeds the annual exclusion, it will be subject to the gift tax regulations.

- Is there a difference between the gift tax and estate tax?

- While both are federal taxes, the gift tax applies to transfers made while a person is alive, whereas the estate tax applies to property left to heirs after a person’s death.

- Where can I get more information or assistance on the gift tax?

- It’s advisable to consult with a financial advisor or tax professional for personalized guidance. You can also refer to the official IRS website for detailed information.

- Are there any strategies to minimize gift tax implications?

- Yes, there are various strategies, such as utilizing the annual exclusion, gifting assets that are likely to appreciate, or setting up trusts. Consulting with a financial planner or tax professional can provide tailored strategies for your situation.