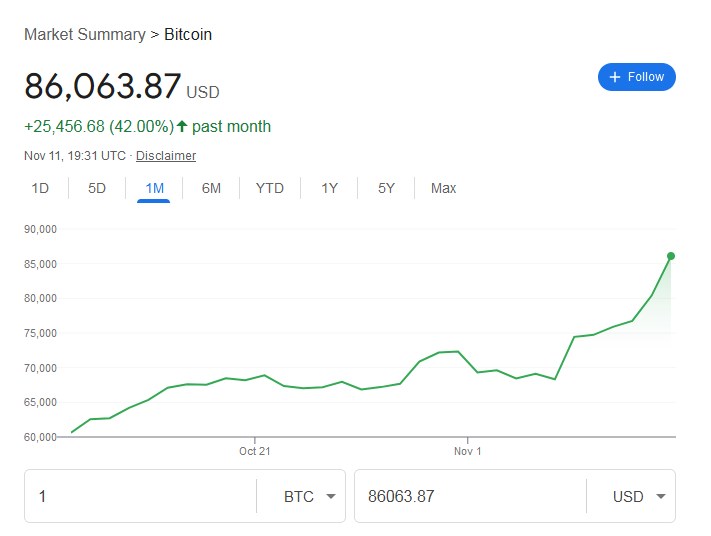

Hold onto your crypto wallets, folks – Bitcoin’s latest dance with $86,000+ isn’t just another bull run tease. We’re watching history unfold as the OG cryptocurrency inches tantalizingly close to the holy grail of price targets: $100,000.

In a plot twist that reads like a financial thriller, Trump’s unexpected election victory has supercharged Bitcoin’s momentum, creating what might be the perfect storm of political backing, institutional adoption, and good old-fashioned FOMO. With just 17% more to go, that six-figure milestone is starting to feel less like fantasy and more like an impending reality check for crypto skeptics.

Bitcoin’s Journey to $100,000: A Perfect Storm of Politics, Tech, and Market Momentum

The New All-Time High: Just the Beginning?

Bitcoin’s meteoric rise to $86,000+ has got everyone buzzing, and let’s be real – we’re all wondering if that magical $100,000 mark is finally within reach. With just 17% to go, it feels like we’re in the home stretch of a marathon that’s been years in the making. And talk about timing – Trump’s 2024 election victory has crypto enthusiasts practically dancing in the streets, with many seeing it as rocket fuel for Bitcoin’s final push to six figures.

Market Dynamics: When Politics Meets Crypto

Here’s where things get interesting – Bitcoin’s surge past $86,000 wasn’t just your typical crypto rally. The market’s practically doing backflips since Trump clinched the election, and institutional money? It’s flooding in like a broken dam. Those spot Bitcoin ETFs everyone was hyping up? They’re actually living up to the hype, pulling in billions faster than you can say “FOMO.”

Economic Puzzle Pieces

The U.S. economy’s giving us mixed signals – like that friend who can’t decide where to eat – but Bitcoin seems to be thriving anyway. That flattening yield curve everyone’s worried about? It’s actually playing right into Bitcoin’s hands. And with Trump’s tariff-happy approach potentially stirring up inflation concerns, good old BTC is looking pretty attractive as a hedge. I mean, when’s the last time you saw central banks this nervous about their monetary policies?

The FOMO Is Real, Folks

Let’s talk about that elephant in the room – investor sentiment is soaring through the roof, and it’s not just because of those fancy suits on Wall Street anymore. Trump’s pro-crypto stance has got retail investors practically throwing their wallets at exchanges. The interesting part? This time around, it’s not just your classic crypto bros driving the rally – we’re seeing suit-and-tie types jumping in alongside the Twitter traders.

Tech and Rules: The Perfect Storm

April 2024’s Bitcoin halving is like Christmas coming early for crypto enthusiasts. Network conditions? Rock solid. And those spot ETFs that finally got the green light? They’re changing the game faster than you can say “institutional adoption.” With Trump potentially shaking things up at the SEC, the regulatory landscape might finally be tilting in crypto’s favor.

What the Experts Are Saying

Ryan Lee’s been dropping truth bombs about Bitcoin’s trajectory, and let me tell you – when he talks about $100,000 being within reach, people listen. Andrey Lazutkin’s taking it even further, suggesting we might be undershooting with our current predictions. But here’s the kicker – they’re not just throwing numbers at the wall. The data’s backing them up, and the momentum feels different this time.

The Plot Twists Ahead

Look, it’s not all sunshine and rainbows – we’ve got some potential storm clouds on the horizon. The SEC might be getting a makeover under Trump, but regulation’s still the wild card in this deck. And let’s not forget about those pesky economic indicators – inflation’s still doing its thing, and interest rates are anyone’s guess. Plus, let’s be honest – crypto’s about as predictable as a cat on caffeine. One tweet from the wrong person, and we could be looking at a whole different ballgame.

But here’s the thing – between the post-election euphoria, institutional money pouring in, and the halving just around the corner, Bitcoin’s got more momentum than a runaway freight train. That $100,000 target? It’s starting to look less like a pipe dream and more like an inevitability. The only real question is when – not if – we’ll get there.

Just remember, in the wild world of crypto, anything can happen. Keep your seatbelt fastened, your portfolio diversified, and maybe don’t bet the farm just yet. But if you’ve been sitting on the sidelines? Well, the water’s looking pretty inviting right about now.

The Road to Six Figures: More Than Just Numbers

As Bitcoin flirts with unprecedented heights, we’re witnessing more than just price action – we’re seeing the culmination of years of institutional acceptance, technological evolution, and shifting political winds. The combination of Trump’s pro-crypto stance, the successful launch of spot ETFs, and the upcoming halving has created a unique moment in crypto history.

While the path to $100,000 might still have its share of bumps and detours, the stars seem to be aligning in Bitcoin’s favor. Between the post-election enthusiasm, institutional money flows, and strengthening network fundamentals, that elusive six-figure target is starting to look less like a question of if, and more like a matter of when.