Bitcoin, the first and most prominent cryptocurrency, has been a topic of intense discussion and speculation since its inception in 2009. Its price has seen dramatic rises and falls, and predicting its future value is a complex task that requires careful consideration of various factors.

This article aims to provide a detailed analysis of Bitcoin’s potential price in 2040, drawing on expert opinions, historical trends, and current market dynamics.

Past Performance

A Decade of Growth

Bitcoin’s journey from a novel idea to a globally recognized asset has been nothing short of remarkable. In 2021, the value grew from $29,374.15 on January 1st to $46,306.45 on December 31st, managing to surpass the $60,000 mark twice, most notably when it reached its all-time high of $68,789.63 on November 10th that year.

The Rollercoaster Ride

Despite the impressive growth, Bitcoin’s journey has not been without its share of turbulence. The cryptocurrency fell over 60% in 2022 amid a wider investor sentiment shift. However, the new year brought some grounds for optimism as the token broke through the $25,000 mark to trade at $29,159.90 – its highest price in nine months – on March 30, 20241.

Bitcoin Halving and Its Impact on Price

The Halving Phenomenon

Maximum supply of 21 million tokens. To reduce the rate at which new bitcoins are issued, the cryptocurrency undergoes halving events roughly every four years.

These events reduce the number of tokens released into circulation by halving their supply, making the token scarcer and potentially raising its value.

Historical Impact of Halving

Research shows that the value of Bitcoin has enjoyed a bull market lasting between 12 and 15 months after each halving event occurred. The past three halving events that took place in 2012, 2016, and 2020 saw the Bitcoin price surge by 9,915%, 2,949%, and 665% respectively.

Factors Shaping Future Price

The Role of Regulation

Solid cryptocurrency regulation will be required to attract more institutional money into the space and boost the price by 2030. Alex Faliushin, the CoinLoan founder and CEO, believes that when the whole industry becomes more transparent and regulated, new money coming into the market could lead to a sharp price rise.

Bitcoin as an Inflation Hedge

A number of analysts have pointed out the similarities between gold and Bitcoin, both are viewed as a natural hedge against inflation.

There is a finite amount of both, they usually have relatively low correlations to equities and fixed income, and they act as a store of value outside of traditional systems such as governments or central banks.

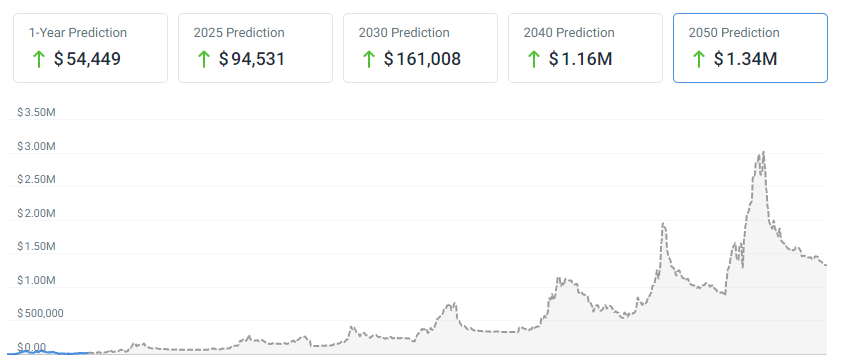

Price Predictions for 2040

Expert Predictions

Several long-term Bitcoin price predictions have been made. DigitalCoinPrice suggests that could trade at an average price of $305,981.72 in 2030, and it could be worth $571,195.49 in 2032.

PricePrediction is extremely bullish, claiming that the price could rise to $564,433.66 in 2030, growing further still to an eye-watering potential $1,168,666.81 in 2032.

According to an analysis from DigitalCoinPrice based on Bitcoin’s average yearly rate of return over the past five years, which is approximately 22%, the future price of BTC could potentially reach $1,050,000 by 2040. This would represent an increase of more than 3,480% from its current price of around $29,300.

It’s important to note that this projection is quite straightforward and doesn’t take into account more complex factors. However, it can serve as a useful starting point for understanding potential future price movements. Ultimately, the performance and its viability as an investment are largely dependent on broader economic and geopolitical factors.

For those interested in customizing these figures to better reflect their personal circumstances or different rates of return, a Bitcoin profit calculator could be a valuable tool.

Optimistic Suggestion

The most optimistic predictions suggest that BTC could reach the $1 million mark by 2030. ARK Invest analyst Yassine Elmandjra and CoinLoan founder and CEO Alex Faliushin both agree with this bullish outlook.

2050

Using Bitcoin’s average annual return over the past five years, which is approximately 22%, we can project the potential price of BTC in 2050. Based on these parameters, BTC price could increase to $7,670,000 by 2050, representing a growth of more than 26,070% over the next 27 years.

However, some might argue that a 22% yearly return over nearly three decades is not realistic. Therefore, we also calculated the potential price using the multi-decade return of the S&P 500 stock index, which has returned an annualized average ROI of around 11.88% since its inception in 1957 through the end of 2021. If Bitcoin follows this rate of return, its price could reach $665,000 by 2050.

Several prominent individuals and institutional investors in the cryptocurrency market have also made their own predictions for Bitcoin’s future price:

- Jesse Powell, CEO of Kraken: Powell believes that a $1,000,000 price tag for Bitcoin in the next 10 years is “very reasonable”. He attributes this potential increase to the devaluation of fiat currencies and the search for a more stable reserve asset.

- Mike Novogratz, CEO of Galaxy Digital Holdings: Novogratz predicts that BTC could hit $500,000 by 2027 due to increased institutional adoption.

- Arthur Hayes, co-founder of BitMEX: Hayes suggests that Bitcoin could reach $1,000,000 as a result of economic sanctions levied against Russia. He believes that BTC will eventually serve as the backbone of a new, neutral financial system, largely untethered to the US dollar and gold.

- Jurrien Timmer, Director of Global Macro at Fidelity: Timmer believes that BTC will follow the adoption curve of historically disruptive technologies, particularly mobile phones. He predicts that Bitcoin could reach as high as $600,000 in 2028.

Is Bitcoin (BTC) a good investment?

BTC, as the pioneer and most trusted blockchain project, has demonstrated its potential to yield substantial returns for investors, particularly with the recent surge in its price. Bitcoin’s real-world use cases and its position as the future of payments add to its credibility.

More financial institutions are expected to adopt BTC as a payment method in the coming years. Based on these factors, a long-term investment in Bitcoin could be a promising option.

However, it’s crucial to remember that Bitcoin, like other cryptocurrencies, is subject to high volatility and can experience significant price fluctuations at any time. For savvy investors who are comfortable with taking risks,BTC could be an excellent choice. Cryptocurrencies are currently among the most lucrative assets, but they are also among the riskiest.

Therefore, before making any investment decisions, it’s essential to conduct thorough risk management. Always ensure that you fully understand the potential risks and are prepared to handle the possible outcomes. As with any investment, it’s advisable to diversify your portfolio to mitigate risks.

Will BTC volatility continue in 2024?

The world’s first and most prominent cryptocurrency, has experienced significant volatility in its price. In November 2022, Bitcoin’s price hit a two-year low amidst broader turbulence in the cryptocurrency markets following the collapse of the FTX crypto exchange. While Bitcoin has managed to recover some of its losses in 2024, it remains far from its record price set less than 18 months ago.

Laith Khalaf, AJ Bell’s head of investment analysis, noted that BTC investors have seen the highest returns among other assets over the past ten years. An investment of £1,000 in 2013 would have grown to over £1.6 million today.

However, he also pointed out that the number of investors who have captured the full ten-year return is likely very small due to the extreme volatility and the challenges of holding onto the investment through multiple price fluctuations.

Viktor Prokopenya, founder of VP Capital, also highlighted that the cryptocurrency markets reward patient investors who can withstand the inherent market volatility. He cited the example of Bitcoin’s value falling from $20,000 to $3,000 in 2017 and noted that seasoned investors understand that the market will bounce back despite periods of instability.

Following the collapse of Terra’s LUNA crypto and its UST stablecoin in May 2022, which led to a fall in Bitcoin’s price, Mike Novogratz, CEO of Galaxy Digital, commented that volatility is likely to continue and the macro situation will remain challenging.

FAQ

How does Bitcoin work?

Each Bitcoin is basically a computer file which is stored in a ‘digital wallet’ app on a smartphone or computer. People can send Bitcoins (or part of one) to your digital wallet, and you can send Bitcoins to other people. Every single transaction is recorded in a public list called the blockchain.

How can I get Bitcoins?

You can buy Bitcoins using ‘real’ money. You can sell things and let people pay you with Bitcoins. Or they can be created using a computer.

Why are they valuable?

They are valuable because people are willing to exchange them for real goods and services, and even cash. Some people like the fact that Bitcoin is not controlled by the government or banks.

Are they legal?

It’s legal to use in most countries, but some countries have banned it. It’s also important to know that Bitcoin is often used for illegal activities, such as buying and selling illegal goods on the dark web.

How is the price determined?

The price of Bitcoin is determined by supply and demand. When demand for bitcoins increases, the price increases, and when demand falls, the price falls.

What is Bitcoin mining?

Bitcoin mining is the process by which new bitcoins are entered into circulation. It also serves to secure the network in which it operates by verifying transactions to the rest of the network.

Can Bitcoin be converted to cash?

Yes, it can be converted to cash in a few different ways. You can sell Bitcoin on a cryptocurrency exchange like Coinbase or Kraken. The cash will be deposited directly into your bank account.

Conclusion

Predicting the future price of Bitcoin is a complex task that requires a deep understanding of various factors. While the potential for growth is significant, it’s important to remember that the cryptocurrency market is highly volatile and unpredictable.

As such, these predictions should be taken with a grain of salt, and potential investors should always conduct their own research and exercise caution.