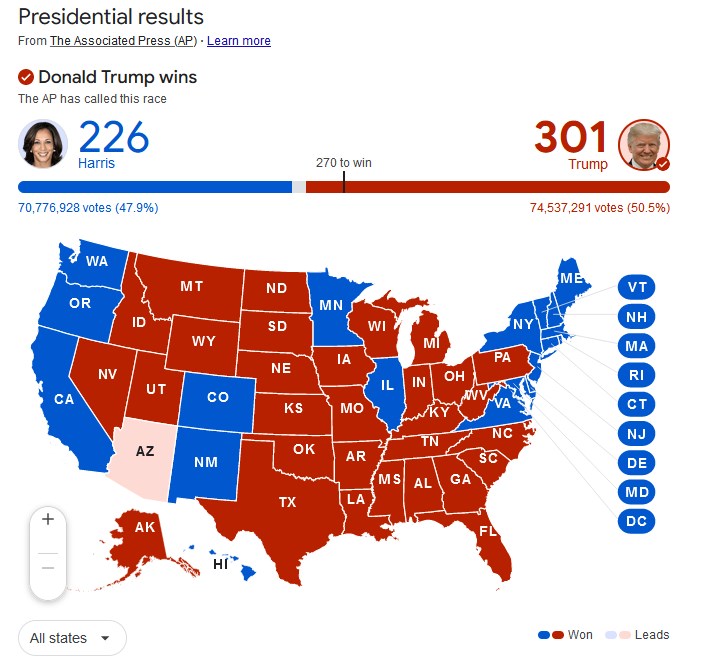

Hold onto your portfolios, folks – Wall Street’s about to get Trumped again! The 2024 election results have sent the financial markets into a frenzy that’s more dramatic than a season finale of your favorite reality show. From champagne-popping bankers to nail-biting environmentalists, everyone’s trying to figure out what Trump’s encore performance means for their bottom line.

Just like in 2016, Trump’s victory has turned the economic playbook upside down, but this time, the stakes are even higher. With promises of supercharged tax cuts, a sequel to the China trade wars, and enough deregulation to make a bureaucrat’s head spin, markets are already dancing to a familiar yet intensified tune.

Introduction and Context

The 2024 political landscape has taken a dramatic turn with Trump’s electoral victory, sending shockwaves through financial markets and boardrooms across America. Wall Street’s bigwigs are already scrambling to position their portfolios for what promises to be an interesting ride – and honestly, can you blame them? The former president’s economic policies and worth, featuring a mix of aggressive tax cuts, deregulation, and that signature “America First” trade policy, is about to get a second act.

The initial market reaction? Let’s just say champagne corks were popping in certain corners of Manhattan. Major indices surged as investors bet big on sectors that thrived during Trump’s first term – think energy, financials, and defense stocks. For everyday investors and market watchers, this electoral outcome isn’t just another headline; it’s potentially a whole new chapter in America’s economic story, complete with all the plot twists and market drama you’d expect from a Trump administration sequel.

Tax Policies

Remember those Tax Cuts and Jobs Act headlines from Trump’s first rodeo? Well, they’re making a comeback – and this time, they’re bringing friends. The plan is doubling down on corporate tax cuts, keeping that sweet 21% rate that had CEOs doing backflips in 2017. And let’s be real – last time around, corporate profits shot through the roof faster than a SpaceX rocket.

But it’s not just about the big business folks. The proposed reforms are throwing a bone to homeowners and seniors too. We’re talking expanded deductions for property taxes (hello, suburban voters!) and some nice tax breaks for the retirement crowd. You know those complicated tax brackets that make your head spin? They’re getting a makeover too, with most middle-class families potentially seeing their rates drop like it’s hot.

Trade Tariffs

Remember those trade wars that had everyone biting their economic impact on markets during Trump’s first term? Well, buckle up, because we’re about to hit replay. Trump’s signature tough-on-China stance is making a comeback, with beefed-up tariffs on Chinese imports looking like a done deal under Trump. Think of it as Trade Wars: The Sequel – now with extra drama.

Here’s the thing: these tariffs are a double-edged sword that’s already got retailers sweating. Sure, they might push American manufacturing, but your shopping cart? It’s probably going to get pricier. We’re talking about everything from those snazzy electronics you’ve been eyeing to basic household items – all potentially taking a hit to your wallet.

The market’s already getting jittery about potential retaliation from Beijing – because let’s face it, trade tensions are like a game of economic ping-pong, and nobody wants to drop the ball. Industries from agriculture to tech are bracing for what could be a wild ride of market swings and supply chain scrambles.

Deregulation Efforts

Wall Street’s getting that déjà vu feeling as Trump’s financial impact makes its grand return. Energy companies are practically doing cartwheels at the prospect of looser environmental restrictions, while banks are eyeing a potential rollback of those pesky Dodd-Frank rules that kept them up at night.

For small businesses, it’s like Christmas came early – fewer paperwork headaches and compliance costs mean more room to breathe and grow. Business regulatory changes that felt buried under regulatory red tape are seeing light at the end of the tunnel.

But here’s the catch – and there’s always a catch – environmental groups are raising red flags faster than you can say “climate change.” Financial watchdogs are also getting nervous, warning about the risks of turning back the regulatory clock too far. Remember 2008? Yeah, nobody wants that particular reunion tour.

Between the cheers from business leaders and the worried looks from regulatory advocates, one thing’s clear: the great American regulation rollback is about to get a second act.

Market Impact: Stock and Inflation

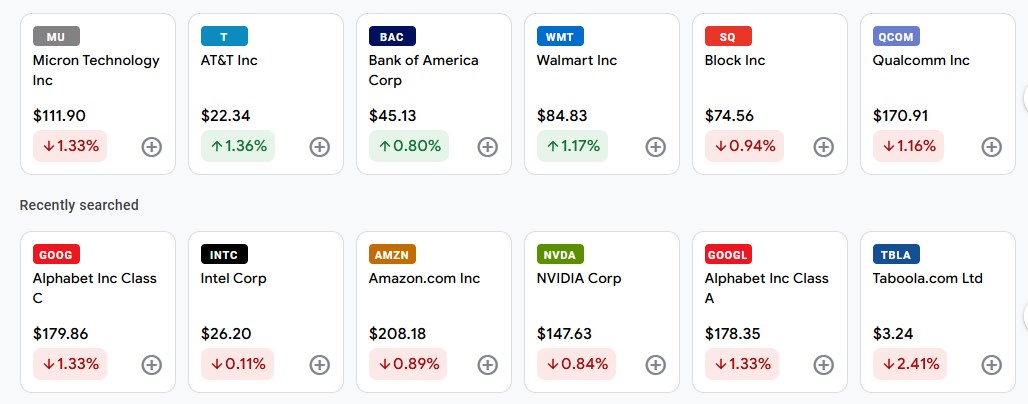

Wall Street’s reaction to Trump’s election victory has been nothing short of electric, with energy and financial sectors leading the charge. Oil companies are riding high on expectations of looser regulations, while big banks surge faster than a Bitcoin rally. It’s like 2016 all over again – but with the volume turned up to eleven.

But here’s where it gets spicy: inflation hawks are circling overhead. Those beefed-up trade tariffs and tight labor market policies? They’re giving economists heartburn. We’re talking about potential price pressures that could make your grocery bills look like premium cable subscriptions.

The renewable energy sector’s taking some hits – those solar and wind stocks are wobbling like a jenga tower in an earthquake. Meanwhile, small-cap stocks are playing a game of wait-and-see, particularly those tied to international trade. Sure, some sectors are popping champagne, but others are reaching for the antacids. It’s a classic case of market musical chairs, and not everyone’s guaranteed a seat when the music stops.

Bond Yields and Interest Rates

The bond market’s getting spicier than a ghost pepper eating contest. Rising yields are making waves across Wall Street, with the 10-year Treasury doing its best impression of a rocket ship. Think of it as the market’s way of saying “Hey, inflation might be sticking around longer than that houseguest who just won’t take the hint.”

Here’s where it gets interesting – these climbing bond yields are putting the squeeze on market valuations climb faster than a python at lunchtime. Growth stocks, especially those tech darlings that were riding high, are feeling the pinch. It’s like watching a game of financial musical chairs, and some players are getting nervous about where they’ll end up when the music stops.

For investors, it’s becoming a delicate balancing act. Higher yields mean better returns on bonds (finally!), but they’re also throwing shade at stocks that were priced for perfection. The smart money’s watching these moves like hawks, knowing that where bonds go, markets often follow.

Expert Opinions and Data Insights

Wall Street’s heavyweights aren’t mincing words about Trump’s economic impact. JPMorgan’s analysts project a 15% surge in the S&P 500, citing potential corporate tax cuts and deregulation as major catalysts. Meanwhile, Goldman Sachs warns of short-term market volatility, particularly in sectors exposed to international trade.

The numbers tell quite a story – defense contractors saw their stock prices jump an average of 12% in the first week post-election, while clean energy stocks took a 9% hit. Traditional energy companies? They’re up a whopping 18%, making market analysts grin wider than kids in a candy store.

Market indicators are flashing some interesting signals too. The VIX – Wall Street’s fear gauge – spiked 22% before settling back down, showing that even the pros are keeping their seatbelts fastened. The dollar index strengthened by 3.2%, suggesting international investors are betting big on America’s economic muscle-flexing round two.

Perspectives: Trump Supporters’ Viewpoints

For Trump’s base, the market benefits look bright as a Mar-a-Lago sunset. Small business owners, in particular, are practically doing backflips over the promised regulatory rollbacks. “It’s like someone finally took the handcuffs off,” says Mike Thompson, a hardware store owner in Ohio who’s already planning to expand his operations.

The enthusiasm isn’t just about cutting red tape – Trump supporters are banking on his market-friendly policies to supercharge their retirement accounts. Remember how the stock market soared during his first term? Many of his followers are betting on a repeat performance, with their 401(k)s ready for another wild ride.

The real kicker for many supporters is the potential for small business growth. With fewer regulations to navigate and promises of continued tax benefits, Main Street’s looking at Trump’s victory like kids eyeing a candy store window. They’re seeing dollar signs where others see controversy, and they’re betting big on Trump’s business-first approach paying dividends – literally and figuratively.

Future Implications

The road ahead looks about as smooth as a rocky mountain trail. With the federal deficit analysis swelling faster than a hot air balloon, we’re talking serious long-term challenges that’ll make your head spin. The wealth gap? It’s stretching wider than a Texas horizon, with economic policy challenges potentially accelerating this economic divide.

The sustainable investing crowd is holding their breath – and not just because of air quality concerns. While traditional energy stocks are doing their victory lap, renewable energy transitions might hit some speed bumps. Think of it like trying to turn a cruise ship in a swimming pool – it’s possible, but it’s gonna take some serious maneuvering.

On Capitol Hill, it’s shaping up to be quite the showdown. Getting these economic policies through Congress? Let’s just say it’ll be about as easy as teaching a cat to swim. With party resistance running hotter than a summer sidewalk, implementation challenges are giving policy wonks some serious heartburn. The political tug-of-war could make getting anything done feel like pushing a boulder uphill – in flip-flops.

The Bottom Line

As Wall Street braces for Trump’s economic encore, one thing’s crystal clear – we’re in for a ride that’ll make a rollercoaster look tame. From soaring defense stocks to wobbling renewable energy shares, the market’s already showing us its cards. The real question isn’t just about who’ll win big – it’s about how long this economic sugar rush can last.

Whether you’re Team Trump or reaching for the antacids, there’s no denying that America’s economic landscape is in for a massive shake-up. With deficit hawks circling and trade tensions simmering, the next four years promise to be anything but boring for your investment portfolio.