When thinking about leasing a car, you are agreeing to rent a vehicle for a set length, frequently 2-4 years. It’s pivotal to enter the leasing method with a grounded know-how of its intricacies to get a fine feasible deal.

Preparation is fundamental, and understanding the right questions to ask earlier than signing on that dotted line permits you to keep away from commonplace pitfalls. Leasing can also provide the attraction of using a brand new car with decreased month-to-month payments than buying, however, it’s not without its complexities that demand your careful attention.

Gaining readability on the lease’s monetary aspects, such as the capitalized value, and residual fee, and being privy to the costs concerned is important. Equally, knowing a way to negotiate your lease agreement can appreciably affect your wallet over the hire period.

Key Takeaways

- Educate yourself on the leasing process to negotiate effectively.

- Detailed cost analysis helps prevent overpaying throughout the lease term.

- Understanding lease-end obligations ensures preparedness for future costs.

Learn Car Leasing Fundamentals

Before you opt for leasing, it’s vital as a way to understand the hire sorts, economic additives, and how depreciation affects your agreement.

Types of Leases and Their Structures

When you rent a brand new vehicle, you may typically come across two primary styles of rentals: closed-give up (or “walk-away”) and open-end (or “finance”). With a closed-cease hire, your economic duty ends whilst the rent expires, so long as the auto is in top condition and inside the agreed mileage.

An open-end rent is less unusual for non-public leasing and is often used by companies. It calls for you to pay the difference if the automobile’s actual worth at the lease end is less than the expected residual price.

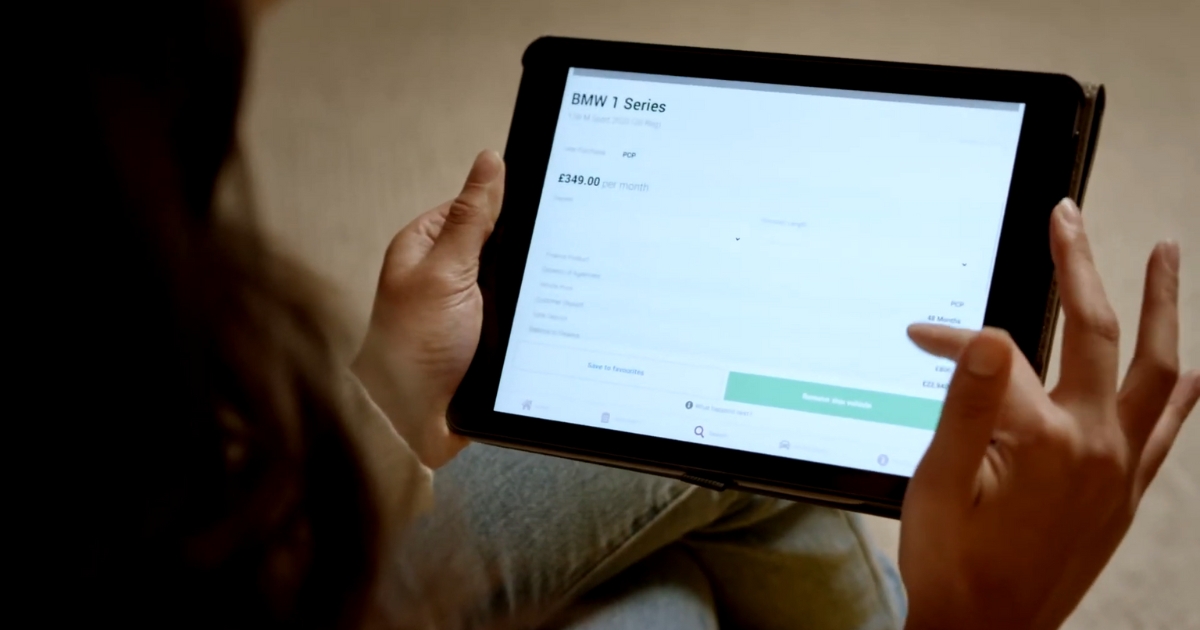

When you learn about different types, then you are ready to decide on your own. If you don’t know where to start looking for a proper deal, you can visit firstvehicleleasing.co.uk.

The Financial Components of Leasing

Understanding the economic terms of rent can save you money. The capitalized cost, much like the acquisition fee in shopping, is the negotiated selling charge of the automobile. The cash thing, analogous to the hobby rate on a mortgage, dictates the financing fees at the lease.

Together, these factors, at the side of other costs and taxes, determine your monthly rent bills. It’s vital to negotiate those prices as you will while shopping for a car.

Residual Value and Depreciation

The residual cost is an estimate of the car’s cost at rent-stop. Depreciation is the discount within the car’s cost over time and is the largest part of your lease price. The better the residual cost, the decrease your fee, as you are deciding to buy the depreciation.

For instance, a new vehicle with an initial price of $30,000 and an anticipated residual fee after 3 years of $18,000 could have $12,000 of depreciation to be blanketed in the hire bills.

When considering leasing options, it’s wise to familiarize yourself with basic car maintenance, including handling unexpected situations like tire punctures – explore our comprehensive guide for practical solutions.

Calculating Your Costs

When considering a vehicle hire, it’s miles essential to comprehensively determine all associated costs to make sure the rent aligns with your financial expectations and talents.

How Monthly Payments Are Determined

Your monthly rent payments are manufactured from the automobile’s depreciation, interest, and taxes. Depreciation is the distinction between the sale charge and the projected residual cost at the rent quit.

A key detail affecting your bills is the car’s residual value; a higher residual way lower month-to-month bills. Be conscious of the hobby, or lease APR, as this determines the fee of financing the rent.

Upfront Costs and Fees

Upon beginning your rent, you may stumble upon preliminary expenses such as:

- A large down payment can lessen monthly bills, but it’s no longer usually required.

- A refundable deposit covers the ability to wear and tear or rent violations.

- Acquisition expenses may also encompass documentation costs and other processing costs.

- The first month’s price is paid prematurely alongside taxes and fees.

Be certain to ask for a breakdown of all extra charges to avoid surprises. Gap coverage can be cautioned to shield you in case the vehicle is totaled before the lease ends.

Mileage Limits and Penalties

You are certain to have a set mileage allowance, regularly around 12,000 to fifteen,000 miles per yr. Exceeding this limit incurs excess mileage prices, detailed inside the nice print of your hire phrases.

These may be steep, so calculate anticipated usage to keep away from hefty consequences. If needed, negotiate a better restriction prematurely or discuss a hire extension. Be aware of potential prices for early termination, as your instances change.

Negotiating Your Lease Agreement

Securing a great deal on an automobile rental requires good information on the leasing manner, knowing what questions to ask, and the use of the right negotiation strategies. Let’s look at how to cope with these negotiations to make sure you are making a knowledgeable dedication.

Asking the Right Questions

Begin using asking approximately the capitalized price, or the automobile’s fee. This is the parent you’ll be negotiating to lower, similar to what you would whilst buying an automobile.

Also, inquire approximately the residual price, which affects your monthly payments, because it reflects what the automobile may be worth at the end of the hire.

Confirm whether or not there are any in-advance payments together with a capitalized price discount, which can be likened to a down fee that lowers the overall cost. Here’s a listing of critical questions:

- What is the precise capitalized fee of the automobile?

- How is the residual value determined?

- Are there any hire prices or taxes no longer included in the quote?

- Can you explain the hire-give-up phrases and conditions?

What to Know Before Signing

Understand all the facets of the dedication before signing. Scrutinize the lease agreement’s best print for details on rent length, rent prices, and taxes that you are predicted to pay.

It’s vital to aspect in extra costs, which include extra mileage fees and wear and tear consequences. An honest way to assess a vehicle’s worth is to check sources like Kelley Blue Book to ensure the hire terms are affordable.

Be clear on the subsequent:

- Total hire term period and month-to-month price responsibilities

- Additional prices associated with the lease

- Potential penalties for wear, tear, and extra mileage

Incentives and Negotiation Strategies

When discussing rent, be aware of any to-be-had lease specials or producer incentives, which can drastically lessen fees. It’s additionally prudent to barter the sale fees one by one from the discussion of your alternate-in cost if relevant. Utilize those strategies:

- Research modern-day rent specials and manufacturer incentives; armed with this information, you can better negotiate your phrases.

- Separate the alternate-in negotiations to avoid conflating it with the hire phrases.

- Aim for a deal that is snug in your finances while being honest about both events.

FAQs

What is a good residual value on a lease?

A desirable residual cost for a vehicle rental is closest to the automobile’s fee at the cease of the rent term. Higher residual values frequently bring about decreased month-to-month bills, as you handiest pay for the depreciation that occurs for the duration of the rent.

What is the effective interest rate of a lease?

The effective interest rate of a lease, additionally called the cash thing, is the financing fee you pay on the lease. It is just like the hobby rate on a loan and affects the whole fee of the rent. The decrease the money issue, the decrease your total lease price might be.

What is interest rate risk in leasing?

Interest-free risk in leasing refers to the capability fluctuation within the lease’s finance charges because of modifications in marketplace hobby prices. This can affect your month-to-month bills if the rent agreement lets in for variable quotes, although maximum vehicle leases use constant fees. Understanding the interest rate danger is crucial to avoid surprising charges.

The Bottom Line

When considering a car lease, your preparation determines the quality of the deal you secure. Take control of the process by asking the right questions, ensuring you understand the lease terms, and being familiar with your financial obligations.

Take the time to read all documentation before signing to ensure you catch all the details. Your vigilance can save you money and avoid stress in the long run.

Embrace the opportunity of a car lease by making decisions grounded in research and sound reasoning. You are now equipped to advance into your leasing journey with confidence.