Everyone has faced financial difficulties at least once. While several individuals can easily deal with it thanks to the help of their parents, others need to find other solutions. Taking online loans is becoming increasingly popular in the USA. People apply for extra cash to cover medical bills, utilities, car or home repairs, and even to buy a property.

If you still do not know how to borrow money online, our detailed guide is right for you! Continue reading to discover all the benefits and drawbacks of online loans in 2024.

Where Can You Get Loans Online?

If you need to borrow money online, you can choose from a variety of attractive options. Many online lenders want to make your loan experience as positive as possible. Applying for a loan through 15M Finance is a great option to borrow money online fast. You no longer need to spend time comparing different lenders. The company will connect you with reliable lenders that will provide you with the best online loan experience.

Types of Online Loans

There are many options available to obtain an online loan, making it possible for everyone to find something suitable for their purposes. Below, you can find the main types of online loans that might be the right solution for your financial situation.

1. Payday Loans

A payday loan is one of the simplest ways to borrow money online. Multiple lenders don’t perform hard credit checks, which allows even people with poor credit histories to get approval. Many payday lenders transfer cash within 24 hours, so you are likely to receive money in your bank account the next business day.

Although payday loans may be your lifesaver in an emergency and can help you with debt consolidation, they can also lead you to the debt cycle. Unlike bank loans, these short-term options must be repaid up to the borrower’s next payday, generally from two to four weeks.

After getting funds, you need to repay a principal along with an interest rate that can reach 400% APR (annual percentage rate). Thus, if you apply for a payday loan, be prepared to pay $10-$30 for every $100 borrowed. For example, a $300 loan will cost you from $330 to $390, so always be careful when applying for such a cash advance option and ensure you can repay it.

Otherwise, lenders can charge you late fees or even report to one of the three main credit bureaus, which can significantly hurt your credit.

2. Bad Credit Loans

Loans for bad credit are an excellent option for people who were rejected by the bank or credit union. Such loans are the right solution for your debt consolidation or paying for unexpected costs. While bad credit lenders accept borrowers with good credit scores, they can also approve those with poor payment histories.

However, the higher your credit score, the more likely you are to get an online loan. Additionally, bad credit borrowers generally pay higher interest rates and receive lower loan amounts.

3. Personal Loans

A personal loan is another common option for those who need to borrow money. You can apply for personal loans through both online and traditional lenders. People with excellent credit scores can get extra cash in a bank or credit union. However, if it is not about you, do not worry! Many online lenders offer personal loans for poor credit borrowers.

Although getting a personal loan is more complicated than a payday one, it is still much cheaper. Personal loan options generally have fixed interest rates of around 2,49%, which make the consolidating debt process more affordable.

You can consider a secured loan if you have a poor credit history. You provide collateral to a lender, such as a car or home, and obtain quick cash despite your credit rating.

4. Auto Title Loans

Title loans are secured loans allowing people to borrow money with no hard credit check. Your available loan amount depends on the value of your car, which is collateral. Auto loan lenders don’t focus on your credit report because they can keep your vehicle if you fail to repay the debt.

Applying for a car loan is risky because missed payments can lead to losing both your money and your auto.

5. Installment Loan

Installment loans are unsecured loans allowing you to borrow money and repay it in equal monthly installments for 2-24 months. In several cases (such as a mortgage), the loan terms can reach 30 years. Most lenders allow you to repay early. However, it often leads to a prepayment penalty, so it is important to read your loan contract carefully to be aware of all the lender’s conditions.

Unlike payday loans, installment options provide you with larger loan amounts, which range from $500 to $5,000. This is not the cheapest loan option. However, while payday loans have an interest rate of around 400% APR, installment loans typically range from 16% to 100%.

You should know that if you miss your monthly payments, you may face extra charges and even negative consequences for your credit score.

Multiple lenders offer various types of installment loans, so everyone can choose the suitable one among the following options:

- Student loans;

- Car loans;

- Mortgages;

- Buy now, pay later loans (BNPL);

- Personal loans.

6. Cash Advances

Getting a credit card cash advance is a great option for short-term debt. Borrowers with excellent credit scores can apply for a 0% APR credit card, which is the cheapest way to borrow money. However, if you can’t do it because of your not-perfect credit, you can meet several difficulties.

Credit card companies generally limit the amount you can borrow, so if you need to make a big purchase, such as a home or car, it may not be suitable for you. Additionally, pay attention to the interest rates, as they can often be too high and lead to a cycle of debt.

7. 401(k) Loans

A 401(k) loan relates to borrowing money from your retirement savings account. You can get cash for debt consolidation and then repay it. As a rule, you can take up to 50% of your total savings, and the sum should not exceed $50,000. You don’t need a perfect credit score to obtain a 401(k) loan, so you can get quick cash with no credit check. Additionally, the interest rates for such a loan option are low, and you are not charged any fees.

Benefits of Online Loans

Online lenders offer a vast selection of loan products for everyone. If you are in need of additional money, consider the several advantages of taking online loans.

1. Convenience

Online loans help you avoid visiting banks or credit unions because you can complete the application process from your PC or smartphone. Several online lenders even offer cash advance apps.

2. No Hard Credit Check

You can get a positive response to your loan request even with a bad credit score. Multiple lenders don’t focus on your report. Instead, they perform a soft credit check to ensure you have a source of stable income. You can prove it via a bank statement or a pay stub.

If they see you can repay the debt, you will likely be approved even with a fair credit history.

3. Minimum risks

Many reputable lenders allow you to prequalify to see your chance of being approved. The pre-qualification is free and does not impact your credit score. Furthermore, if you choose a reliable online lender, you do not need to worry about the safety of your personal data.

4. Simple Loan Application Process

Getting a loan online is much simpler than getting one from traditional financial institutions, such as federal credit unions or banks. You do not need to provide online lenders with additional documentation and wait for a month to get a response to your loan request.

Drawbacks of Online Loans

If you want to borrow money online, you should also be aware of several problems you may face.

1. High-Interest Rates

Online loans are often more expensive than borrowing from banks or credit unions. Always read your loan contract carefully, especially if you are applying for loans with bad credit.

2. Expensive Fees

Missing your monthly repayments can lead to expensive late fees, making returning your loan more complicated and potentially causing you to fall into a debt cycle. If you fail to repay the funds, the loan provider can report it to the credit bureau or even to the collection agency, which will significantly damage your credit. Therefore always make your loan payments on time to avoid any negative consequences.

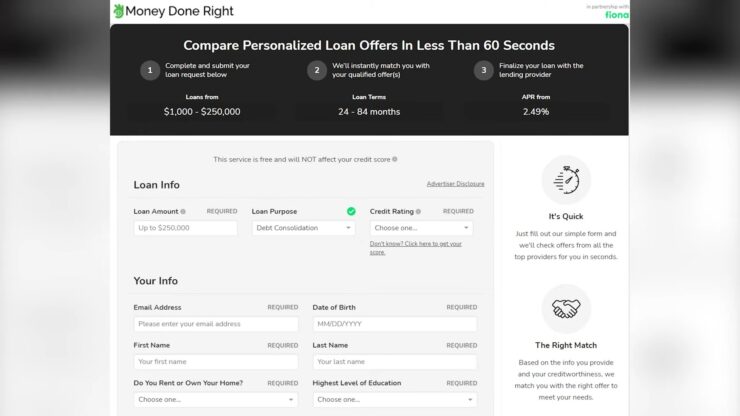

How to Apply for Online Loans?

Obtaining a loan online is much simpler than it may seem! As a rule, you need to take three simple steps:

- Submit an application. Fill in the loan application form with your personal data and bank account details.

- Get an approval decision. If approved, the direct lender contacts you almost instantly.

- Sign a loan agreement. The online lender will send you a loan agreement. Carefully read and sign it if you agree with all the conditions.

- Receive funds. The lender will send you the cash after you sign the contract. The loan money is generally credited to a bank account the next business day.

Eligibility Criteria for Online Loans

Direct lenders offer loans online for all Americans, so you can compare various options and choose the most suitable one. While each loan provider has its own criteria for borrowers, there are several common eligibility requirements you must meet. Therefore, to obtain the desired loan amount, you need to do the following:

- Be a US citizen or permanent resident;

- Be 18 years of age or older;

- Have a live checking account;

- Have a phone number and email;

- Have a steady source of income.

FAQ

How Can I Get a Loan Immediately?

Online lenders need time to process your loan enquiry, so you will likely get a loan as soon as the next business day. However, several loan providers offer same-day deposits, so read your loan agreement carefully before signing.

When Do I Need to Repay a Payday Loan?

You need to return your payday loan by your next payday, which generally takes from two to four weeks. Avoid missing your loan repayments, as it can result in additional fees and a drop in your credit score.

How Much Can I Borrow from Payday Lenders?

Payday loans are a great option to pay for small financial expenses, such as rent or utilities. They allow you to borrow $100-$1000 by your next paycheck. To make more expensive purchases, consider other online loans, such as installment or personal loan options.

When Do I Need to Apply for a Short-Term Loan?

Short-term loans are a great solution when you face a financial emergency, such as credit card debt, home or car repair, and unexpected medical bills. However, apply for such loans only if you don’t have alternatives because you may pay too much for the interest.

I Need to Get a Payday Loan Today. How Can I Do It?

Although many online lenders transfer the funds on the next working day, several loan providers offer same-day deposits. You can get the money in your checking account if you get an approval decision by non. However, always ask your online lender about such a possibility.