Bank failures are not as rare as one might imagine. Since the dawn of the 21st century, we’ve witnessed the collapse of 564 banks, with the lion’s share occurring during the tumultuous period of the 2007–2008 Financial Crisis and the ensuing Great Recession. In the year 2010 alone, a staggering 157 banks crumbled.

The primary villain of this story was the toxic subprime mortgage debt, a financial specter that cast a long shadow over all corners of American life.

Countless homeowners, many of whom were unsuspecting victims of predatory lending schemes, found themselves entangled in the complex web of their low-cost housing loans. As interest rates began to climb, these individuals were caught off guard and defaulted on their monthly payments.

They had cleverly packaged these mortgages into easily tradable securities known as collateralized mortgage obligations (CMOs). These debts were sliced into sections, or tranches, each carrying a different level of risk.

As one might expect, the riskiest tranches promised the most enticing returns. However, as the foundational mortgages started to falter, the CMOs lost their value, triggering a financial tsunami that swept through the entire banking system.

Mortgage lenders found themselves declaring bankruptcy and even global investment behemoths like Lehman Brothers were not immune to the financial devastation. Government-sponsored enterprises such as Fannie Mae and Freddie Mac teetered on the brink of collapse.

The stock market crash in September 2008, which saw the Dow Jones Industrial Average plummet nearly 500 points, signaled the onset of an 18-month recession. This economic downturn was second only to the Great Depression in terms of its severity and impact.

The 2024 Banking Crisis: The Fall of SVB

In 2024, the banking sector was hit by another significant wave of turbulence. While the full details of these failures are still being unraveled, early indications point to two major banks facing substantial difficulties.

The Collapse of SVB

One of the most notable failures in 2024 was that of SVB (Silicon Valley Bank), renowned for its focus on technology companies. They found itself in a crisis due to a blend of risky investments and an unfavorable economic climate. The exact details of the failure are still under investigation, but it has ignited a wider discussion about capital requirements and risk management in the banking sector.

According to a report by CNBC, the collapse of SVB has led to calls for banks to bolster their rainy-day funds. This is seen as a necessary step to prevent a similar crisis in the future. The Wall Street Journal also reported that big could face a 20% boost to capital requirements in the wake of the SVB failure.

HSBC UK acquired the London-based subsidiary of Silicon Valley Bank for £1 ($1.21) in March after its U.S. parent company collapsed. Despite not having a significant customer base in the U.K., the bank’s failure was seen as potentially highly damaging to the tech sector. As a result, the government stepped in to facilitate a deal over a weekend.

The CEO of HSBC UK, Ian Stuart, assured that Silicon Valley Bank UK would continue to serve startup businesses from “seed funding to IPO,” and that it would remain ringfenced within HSBC UK, with its own board and risk policies. Theyis expected to relaunch under a new name, which sources suggest will be HSBC Innovation Banking.

- Assets: 209$ Billion

The Downfall of First Republic Bank

First Republic Bank, based in San Francisco, CA, with assets amounting to $229 billion, was another significant casualty in the banking crisis of 2024. Despite a consortium of eleven of the country’s largest pooling resources to provide a $30 billion lifeline, the regional bank, which primarily served tech startups such as student loan app developers, couldn’t be saved.

The bank had a niche and affluent customer base, many of whom maintained large deposits that exceeded the FDIC’s $250,000 insurance limit. By the time they declared insolvency on May 1, 2024, its loan-to-deposit ratio had tipped precariously, with loans exceeding deposits.

The failures of Silicon Valley Bank and Signature Bank had already sent shockwaves through the financial sector, and the situation at First Republic Bank only added to the growing sense of unease. In March 2024, two credit rating agencies, Fitch and S&P Global, downgraded the, further eroding confidence. In a state of panic, First Republic’s customers withdrew more than $100 billion, nearly half of its total assets, leading to its eventual collapse.

- Assets: 229$ Billion

- Date of Collapse: May, 1. 2024

The Financial Crisis of 2007-2008

The Financial Crisis of 2007–2008, also known as the Global Financial Crisis (GFC), was a severe worldwide economic crisis. It was the most serious financial crisis since the Great Depression (1929). Predatory lending targeting low-income homebuyers, excessive risk-taking by global systemic, and the bursting of the United States housing bubble culminated in a “perfect storm.”

Mortgage-backed securities tied to American real estate, as well as a vast amount of derivatives linked to those securities, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

Washington Mutual

The largest failure in U.S. history occurred on September 25, 2008, when Washington Mutual, with $307 billion in assets, closed its doors. Known as WaMu, they were heavily involved in the subprime mortgage crisis and had faced a run from customers withdrawing their deposits.

The Federal Deposit Insurance Corporation (FDIC) seized the bank and sold its assets to JPMorgan Chase for $1.9 billion.

- Biggest Failure of the Financial Crisis: Washington Mutual, Henderson, Nevada

- Failure Date: September 2008

- Assets: $309 billion

IndyMac Bank

IndyMac was one of the largest bank failures of the financial crisis. The California-based bank specialized in unconventional loan products and faced a run in mid-2008 as the housing market collapsed.

The FDIC took over the bank on July 11, 2008, after it failed to find a buyer. At the time of its failure, IndyMac had assets of $32 billion.

- Failure Date: July 11, 2008

- Assets: 32$ billion

The 1980s: The Era of Junk Bonds and the Savings & Loan Crisis

The 1980s witnessed another form of high-yield debt, colloquially known as junk bonds, triggering crisis that primarily impacted community banks. The Savings & Loan Crisis was a direct result of the collapse of these risky securities, which were often issued by companies in urgent need of cash.

Smaller banks had heavily invested in these bonds to bolster their balance sheets, which were suffering from losses due to the era’s intense inflationary pressures. As interest rates soared, these savings and loan associations (S&Ls) found themselves unable to generate sufficient capital from their depositors to counterbalance their liabilities.

By the time the dust settled, 1,043 savings and loan associations had failed, representing more than half of the country’s total. Michael Milken, often seen as the face of securities fraud during this period, was sentenced to two years in prison and ordered to pay a hefty fine of $600 million.

The Largest Failure of the S&L Crisis: American Savings & Loan Association

On September 7, 1988, the American Savings & Loan Association, based in Stockton, California, experienced the most significant failure of the S&L Crisis. At the time of its collapse, it held assets worth $30.2 billion, marking a significant moment in the history of American banking and highlighting the devastating impact of the Savings & Loan Crisis.

- Failure Date: September 7, 1988

- Assets $30.2 billion

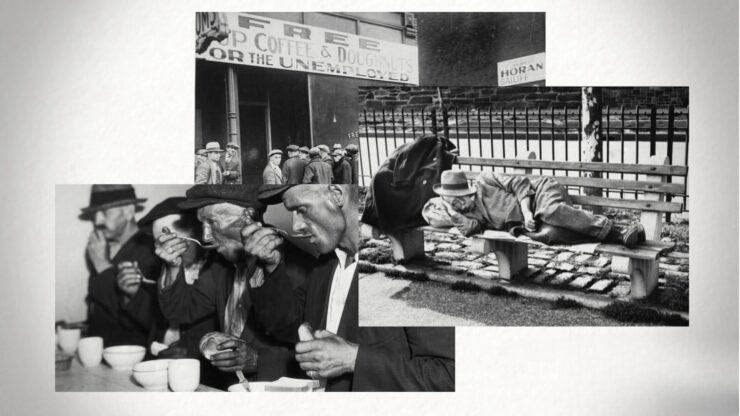

The Great Depression 1930s: A Dark Era

The 1930s were a time of unprecedented peril for banks, with nearly 9,000 financial institutions collapsing and wiping out $7 billion in depositor assets. In those days, deposit insurance was a concept yet to be introduced, resulting in millions of Americans losing their entire life savings with no hope of recovery.

In response to this financial catastrophe, the New Deal reforms were introduced, including the 1933 Act, more commonly known as the Glass-Steagall Act. This legislation brought much-needed regulation to the nation’s financial institutions and paved the way for the establishment of the Federal Deposit Insurance Corporation (FDIC).

The Most Significant Failure of the Great Depression: Bank of the United States

In December 1931, the Bank of the United States, based in New York, New York, experienced the largest bank failure of the Great Depression. At the time of its collapse, the bank had assets worth $200 million, a staggering amount for that era. This event marked a significant moment in the history of American banking, underscoring the devastating impact of the Great Depression on the financial sector.

- Failure Date: December, 1931

- Assets: $200 million

FAQ

What happens to my money if my bank fails?

If a bank fails, the Federal Deposit Insurance Corporation (FDIC) protects depositors. The FDIC insures deposits up to $250,000 per depositor, per FDIC-insured bank, per ownership category. This means that even if your bank fails, your deposits are still safe up to this limit.

What is the role of the FDIC during failure?

The FDIC is responsible for ensuring the stability and public confidence in the U.S. financial system. When a bank fails, the FDIC steps in to protect the depositors by either finding a healthy bank to buy the failed bank or by paying depositors directly for their insured amounts.

What are some signs that a bank might be in trouble?

Some signs that a bank might be in trouble include a sudden change in leadership, frequent changes in business strategy, a significant drop in the bank’s stock price, or negative news about the bank’s financial health. However, it’s important to remember that these signs do not necessarily mean that a bank is going to fail.

What can I do to protect my money?

To protect your money, make sure your deposits do not exceed the FDIC insurance limit of $250,000 per depositor, per FDIC-insured bank, per ownership category. It’s also a good idea to keep an eye on the financial health of your bank and to diversify your investments.

What is a “bank run”, and how does it contribute to a bank’s failure?

A bank run occurs when a large number of customers withdraw their deposits simultaneously over concerns of the bank’s solvency. As banks typically keep only a fraction of deposits as cash reserves, a bank run can lead to bankruptcy.

What are “junk bonds” and how do they impact?

Junk bonds, also known as high-yield bonds, are bonds that carry a higher risk of default than most bonds issued by corporations. These bonds offer high-interest rates to compensate for their risk. If a bank invests heavily in these bonds and the issuing companies default, the bank could face significant losses.

What were the New Deal reforms, and how did they affect banking?

The New Deal reforms were a series of programs and policies established in the 1930s by President Franklin D. Roosevelt to help the U.S. recover from the Great Depression. One of these reforms, the Glass-Steagall Act, introduced banking reforms to control speculation and established the FDIC to protect bank depositors.

What is subprime mortgage debt, and how did it contribute to the 2007-2008 Financial Crisis?

Subprime mortgage debt refers to home loans given to borrowers with poor credit histories. These loans carry higher interest rates to compensate for their risk. During the 2007-2008 Financial Crisis, many of these subprime mortgages defaulted, leading to significant losses for banks and other financial institutions.

What is the role of credit rating agencies in the banking sector?

Credit rating agencies assess the creditworthiness of banks and their financial instruments. A downgrade in a bank’s credit rating can affect the bank’s ability to borrow money and can impact investor confidence.

Final Words

The history of banking in the United States is marked by periods of significant turmoil, with bank failures often serving as a barometer of larger economic crises. From the Great Depression to the Savings & Loan Crisis of the 1980s, the Financial Crisis of 2007-2008, and the recent banking crisis of 2024, these events have had profound impacts on the economy and the lives of millions of people.

Each crisis has been unique, driven by a complex interplay of economic conditions, regulatory environments, and financial innovations. Yet, they all share common threads: risky investments, economic downturns, and often, a lack of understanding or oversight of new financial products.