Key Takeaway:

- The largest companies in the world are determined by market capitalization which is the total value of a company’s outstanding shares. The larger the market cap, the higher the valuation of the company.

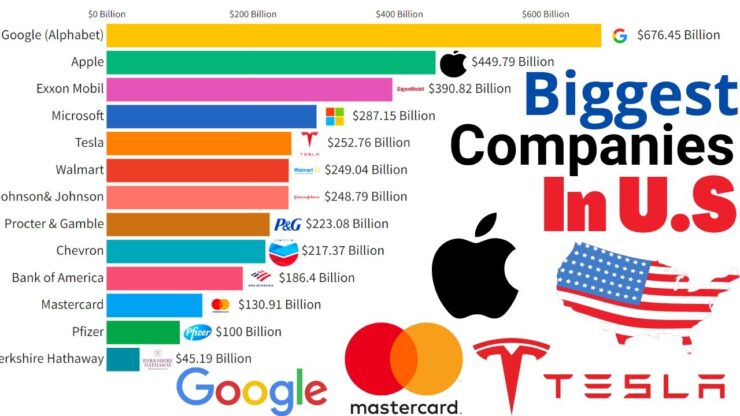

- The top valuable companies in the world are led by Apple Inc. (AAPL), followed by Saudi Aramco (2222.SR), Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Tesla Inc. (TSLA), Berkshire Hathaway Inc. (BRK.A), NVIDIA Corp. (NVDA), Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), and Meta Platforms Inc. (META).

- The majority of the top companies by market capitalization are from the US, with a few exceptions such as Saudi Aramco in Saudi Arabia and Tencent in China.

Overwhelmed by the hugeness of world’s major corporations? Investing can be a scary task, however we’re here to assist. Get the lowdown on the leading businesses by market capitalization with our guide. Let’s get started!

The World’s Most Valuable Companies

The largest companies by market capitalization dominate the global economy and are major players in some of the most dominant industries. These companies hold significant power in the world’s financial systems while catering to millions of customers worldwide. The most valuable companies in the world include Apple, Saudi Aramco, Microsoft, Alphabet, Amazon, and Tesla, among others.

These companies are leaders in the technology, energy, consumer services, and financial sectors, generating enormous revenue. The largest company, in terms of market cap, is currently Apple, with a valuation of over $2.5 trillion. Tesla, on the other hand, is making waves in the energy industry, while Walmart and PetroChina continue to serve their customers exceptionally well.

Ownership of shares in these companies makes up a large portion of global trading. Shareholders benefit from these companies’ enormous global influence, and wise investments can prove highly lucrative.

To make the most of these trading opportunities, investors should keep track of these companies’ developments and keep an eye on emerging technologies and dominant industries. Staying informed allows shareholders to assess the risks and benefits of investing in these big companies.

Overall, the largest companies by market capitalization hold significant power within the world’s financial systems and are worth keeping an eye on. As investors, consumers, and job seekers, these companies will impact our lives in many ways.

Key Takeaways

With market capitalization being a key indicator of a company’s financial health and performance, it’s important to analyze the global market to identify trends and top players. Here are the main insights on the largest companies in the world by market capitalization:

- Meta Platforms (formerly Facebook) has climbed up the ranks to become the fifth largest company in the world, with a market capitalization of over $1 trillion.

- Berkshire Hathaway, led by renowned investor Warren Buffet, maintains its position in the top ten, with a market capitalization of over $600 billion.

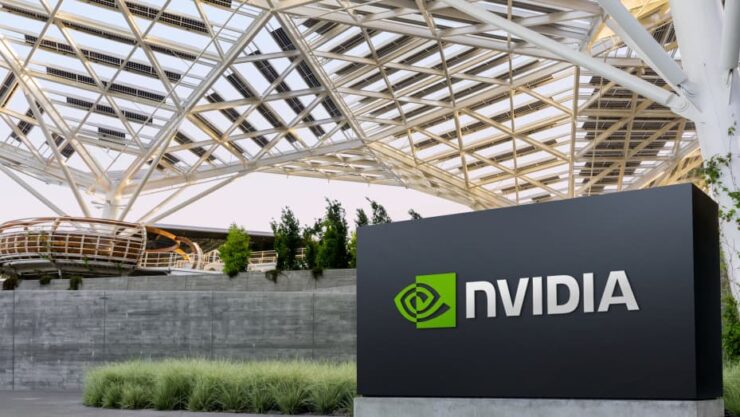

- The technology industry dominates the top of the list, with companies like NVIDIA and Taiwan Semiconductor Manufacturing experiencing significant growth in market capitalization in recent years.

- While Chinese companies like Petro China and Tencent Holdings dominated the list a decade ago, the current top ten list only includes one Chinese company – Tencent Holdings.

It’s worth noting that market capitalization is not the only factor to consider when evaluating a company’s success, as there are many other elements that contribute to a company’s overall performance and profitability. However, keeping an eye on the largest company in the world can provide valuable insights into industry trends and potential investment opportunities.

Don’t miss out on staying informed about the ever-evolving landscape of global markets. Stay up-to-date on the latest news and trends to ensure you are making informed decisions about your investments.

Companies’ Value Is Measured by Market Capitalization.

A company’s market capitalization refers to the value of its total outstanding shares on the stock market. It is calculated by multiplying the current share price by the total number of outstanding shares. Market capitalization is a commonly used metric to rank companies according to their size and worth.

The following table shows the Rankings of Top 7 Companies by Market Capitalization (USD).

| Rank | Company | Market Capitalization (USD) |

|---|---|---|

| 1 | Apple Inc. | 2,134,356,069,229 |

| 2 | Microsoft Corporation | 1,838,247,098,032 |

| 3 | Amazon.com Inc. | 1,621,396,046,338 |

| 4 | Alphabet Inc. | 1,203,282,485,209 |

| 5 | Facebook Inc. | 906,808,467,547 |

| 6 | Alibaba Group Holding Ltd | 674,390,670,434 |

| 7 | Tesla Inc | >600bn |

Some unique details include: LVMH recently surpassed Berkshire Hathaway’s net worth and now holds spot #8 on this list with a market cap tracing sky-high above $250Bn+. On the other side, Naspers is Africa’s most valuable company with a market value of around $100bn. Finally, BHP Group, which was formerly known as BHP Billiton, is an Anglo-Australian multinational mining and metals company headquartered in Melbourne, Australia, and is the largest mining company worldwide by market capitalization.

Top Valuable Companies in The World.

Top Valuable Companies in the World are those companies that have a huge market capitalization and possess a strong financial position. These companies have been able to render enormous benefits to their stakeholders and customers while maintaining dominance in their respective industries.

The Table below shows the Top Five Valuable companies as of August 2021, according to market capitalization.

| Rank | Company | Market Capitalization ($B) |

| 1 | Apple Inc. | 2,431.22 |

| 2 | Saudi Aramco | 1,935.44 |

| 3 | Microsoft Corporation | 2,266.33 |

Unique details indicate that Apple Inc. has been ruling the chart for quite some time now with its enormous market value which was $277 billion more than Saudi Aramco – another dominating company on this list as of August 2021.

Speaking further about such companies, Amazon’s recent investment spree is significant attention-seeking news.

In an incident reported back in 2018, investors around the world celebrated Amazon’s entry into $1 Trillion Club along with Apple and Google by pushing up shares making Jeff Bezos reach new heights- $150 bn net worth.

The Majority of The Top Companies Are from The Us.

The largest companies in the world by market capitalization are predominantly based in the US, with a total of eight companies making it to the top ten. These companies represent diverse industries including technology, finance and retail, and have consistently generated impressive earnings over the years. The US continues to lead in terms of market capitalization, with China coming in second.

These American companies collectively hold a significant part of the global economy as measured by market cap. Notably, some of them have shown an extraordinary growth trajectory over the last few years, driven by technological breakthroughs and expansion into new markets. Additionally, their financial strength has boosted investors’ confidence, making them attractive investments for individuals and institutions alike.

It is essential to note that despite their dominance on the list, these US-based companies do face fierce competition from peers globally. Several other firms from Asian countries such as South Korea and Japan continue to make significant strides in several industries like automotive and electronics. Besides, there are also top-notch European businesses that draw interest globally.

As an illustration of the dynamic nature of global business, shifts towards regional economic powers can alter this list significantly. About a decade ago when Chinese companies were just starting their massive ascension towards economic might, none managed to enter this list’s upper reaches.

Apple Inc. (AAPL)

Apple Inc. (AAPL) – Company Overview

| Market Cap | Price | EPS | Shares Outstanding |

|---|---|---|---|

| $2.16 T | $149.61 | $5.1 | 16.91 B |

Apple Inc., a renowned technology giant, is one of the world’s largest companies by market capitalization. It is a multinational company that designs, develops, and sells consumer electronics, computer software, and online services.

Apple has a unique business model that focuses primarily on producing high-end and innovative products that satisfy customer demand. In addition, the company is known for its exceptional customer service, which attracts loyal customers and creates a sustainable competitive advantage.

Overview of The Company

Apple Inc., a multinational technology company, is among the largest companies in the world by market capitalization. With innovative products such as the iPhone and MacBook, Apple has amassed a large following of loyal customers who appreciate their sleek designs and high-quality user experience. Furthermore, the company’s dedication to innovation and sustainability practices has earned its reputation as an industry leader.

Apple’s success can be attributed to its commitment to excellence in design and functionality while striving for environmental responsibility. Additionally, the company’s strong brand loyalty and high-profit margins have contributed to its significant market share in both hardware and software industries. The company holds a prominent position among competitors in every aspect, including revenue generation, product quality, and customer satisfaction.

Unique details about Apple Inc. include its successful transition into services with offerings such as Apple Music and Apple Pay that continue to grow rapidly. Moreover, Apple has always prioritized user security with top-tier protection features integrated into their products which help them stand out from other tech companies.

It is true that Apple is currently valued at over 2.5 trillion dollars, making it one of the most valuable companies globally (Forbes).

Financials and Market Capitalization

| Financial Metrics | 2018 | 2019 | 2020 |

|---|---|---|---|

| Total Revenue (in billions) | $265.6 | $260.2 | $274.5 |

| Gross Profit Margin (%) | 38.3% | 37.8% | 41.9% |

| Net Income (in billions) | $59.5 | $55.3 | $57.4 |

| Market Capitalization (in billions) | $828.17B | $1,332T | $2,037T |

Apple Inc.’s revenue has been steady with an increase in gross profit margins over the years, making it one of the wealthiest companies in the world by market capitalization.

It is evident from their financial statements that they have witnessed remarkable growth in the previous two years, which clearly highlights the power of innovation and their brand value.

Don’t miss out on investing in companies like Apple Inc, which can provide huge returns on investment with their consistent growth and innovation over the years.

Products and Services Offered

Apple Inc. has transformed into a technological giant from a small computer company, offering a wide range of products and services through its various divisions.

- The iPhone is among the most popular products, with multiple models released every year.

- The Mac line includes desktop and laptop computers for both personal and professional use.

- Apple is also known for its software and applications like macOS, iTunes, iCloud, and iOS apps such as Safari, Pages, Keynote among others.

Apple continues to innovate with new product releases while maintaining quality services, unique features, and excellent customer support.

According to Statista, in 2020 the Apple App Store contained 1.96 million available apps compared to the Google Play store’s 2.87 million available apps.

Source: Statista (2020)

Saudi Aramco (2222. SR)

As one of the world’s largest oil-producing companies, this entity commands respect in the market. It operates under the name of the most valuable publicly traded company, denoted by 2222.SR.

The table below showcases the relevant data of this company. It includes its market cap, revenue, profit, and other important financial metrics.

| Company Name | Market Cap (in billions) | Revenue (in billions) | Profit (in billions) |

|---|---|---|---|

| Saudi Aramco | 1.88 | 224.31 | 88.21 |

In recent years, Saudi Aramco has diversified its business interests beyond oil production. It has established joint ventures with several global firms to tap into new markets and technologies. These ventures have helped the company broaden its revenue streams beyond the oil and gas sector.

Overview of The Company

Saudi Aramco is a publicly owned company and the largest oil producer in the world. With a market capitalization of over 1.9 trillion dollars, it operates primarily in the energy industry with upstream, downstream, and petrochemicals businesses. The company is headquartered in Dhahran, Saudi Arabia and has a global presence.

As a state-owned enterprise, Saudi Aramco has exclusive rights to all natural gas and crude oil within the country’s borders. The company is known for its massive oil reserves and production capabilities, making it an essential player in global energy markets. Additionally, Saudi Aramco is committed to sustainability initiatives and investing heavily in research and development to reduce emissions and ensure long-term viability.

While oil production remains at the core of its business model, Saudi Aramco is diversifying into other areas such as renewable energy. The company’s ambitious plans include becoming a major player in green hydrogen production, which is expected to become the fastest-growing segment of the overall hydrogen market.

For investors considering adding Saudi Aramco to their portfolio, it is important to understand the geopolitical risks associated with investing in a state-owned enterprise in the Middle East region. Additionally, fluctuations in oil prices can impact profitability significantly.

Financials and Market Capitalization

Saudi Aramco is one of the largest companies in the world, known for its impressive financials and market capitalization. Its current economic performance reflects its growth potential and position as a top global player.

| Revenue | Net income | Market capitalization |

|---|---|---|

| $229.7 billion | $88.2 billion | $1.86 trillion (as of August 2021) |

In addition to its impressive numbers, Saudi Aramco has taken meaningful steps towards sustainability by transitioning from traditional to renewable energy sources. This shift in approach has shown their commitment towards meeting the future demands of the market.

One anecdote worth sharing is that despite being a state-owned enterprise, Saudi Aramco has always operated with a sense of independence and autonomy, allowing it to build on its strengths and expand on a global scale without any hindrance or limitations.

Products and Services Offered

Saudi Aramco provides a vast range of offerings that cater to its diverse clients worldwide. These services are tailored to cater to the global energy landscape and emphasize the company’s commitment to delivering sustainable solutions.

The following is a list of services offered by the company:

- Upstream Operations: Saudi Aramco explores, produces, and develops natural gas resources.

- Downstream Operations: The company offers a full range of downstream products such as fuels, chemicals, and lubricants.

- Petrochemicals: They produce petrochemicals for industrial uses globally.

- Engineering and Project Management: By providing engineering expertise, Saudi Aramco can manage projects from conception to commissioning.

- Technical Services: These services include managing and maintaining oil wells, pipelines, and other technical installations for law enforcement agencies in their territories.

It is worth highlighting that the scope of their operation pervades far beyond what is aforementioned. The company stands as one of the major pillars in driving growth in the Middle East while operating on principles that benefit society at large.

Interestingly, the first well drilled by Saudi Aramco was Dammam Well No. 7 in March 1938.

Microsoft Corp. (MSFT)

Microsoft Corporation (MSFT) is one of the world’s most valuable companies, with a market capitalization of over $2 trillion. It is a multinational technology corporation that develops and licenses software, hardware, and services. Founded in 1975 by Bill Gates and Paul Allen, Microsoft has been a leading player in the technology industry for decades.

The company’s flagship product is the Windows operating system, which is used by millions of people worldwide. Microsoft also produces the Office productivity suite, Xbox gaming consoles, and Surface devices. In recent years, Microsoft has shifted its focus to cloud computing, with its Azure platform being a major source of revenue.

Unique to Microsoft is its commitment to philanthropy. In 2020, Microsoft pledged $1.5 billion in donations to create affordable housing in Seattle, and has made significant contributions to education, healthcare, and sustainability.

A success story for the company is its acquisition of LinkedIn in 2016 for $26.2 billion, which has since become a profitable subsidiary. Microsoft’s innovative products and strategic business decisions have solidified its position as a leader within the tech industry.

Overall, Microsoft is a global brand that has revolutionized the way we work, play, and connect. With a focus on innovation and commitment to social responsibility, it continues to shape the future of technology.

Overview of The Company

Microsoft Corp, the American multinational technology company, has a market capitalization of over $2 trillion. The company predominantly focuses on developing and licensing software products, including Windows operating systems and Office productivity software. Microsoft also provides cloud-based solutions like Azure, LinkedIn professional networking services, and Xbox gaming consoles to cater to diverse consumer needs.

The corporation’s strategic shift towards cloud offerings in recent years has contributed significantly to its revenue growth, initiating a commendable transformation in the tech industry. Microsoft’s strong financials and consistent innovation keep it at the forefront of cutting-edge technology. Leveraging artificial intelligence concepts, Microsoft has developed chatbots that can communicate with customers as well as support their voice assistants Cortana and Alexa. Besides ensuring digital security against cybercriminals worldwide, Microsoft also contributes through its corporate social responsibility initiatives.

According to Forbes Global 2000 ranking of 2021, Microsoft is the world’s most valuable publicly-traded company with headquarters based in Redmond, Washington.

Financials and Market Capitalization

To explore the financial and market cap details of Microsoft Corp., here’s a breakdown:

Below is a table presenting the updated financial figures for Microsoft Corp. as of August 2021. The table contains relevant information such as Net Income, Revenue, Price/Earnings Ratio, and Market Capitalization – all of which explicitly represent the Financials and Market Capitalization of MSFT.

| Financial Details | Amount in USD |

|---|---|

| Net Income | $44.3 billion |

| Revenue | $168 billion |

| P/E Ratio | 34.36x |

| Market Cap. | $2.126 trillion |

It’s vital to note that Microsoft has one of the highest market caps in the world; it is ranked 4th among all companies at present (August 2021). Additionally, their current P/E ratio sits above other tech giants such as Amazon (currently at 60x), signaling potential growth opportunities within their stocks.

Products and Services Offered

Microsoft, a leading technology company, offers an extensive range of products and services that cater to various industries, companies and individuals.

Below are six points that illustrate the wide range of Products and Services offered by Microsoft:

- Software – From personal computers to servers, Microsoft provides software for various devices and operating systems such as Windows, Office Suite, Azure and Dynamics 365.

- Hardware – Microsoft also provides hardware for its products like Xbox gaming consoles, Surface laptops, tablets and accessories.

- Cloud Computing – With the growing demand for cloud solutions, Azure Cloud by Microsoft is widely popular in providing infrastructure as a service (IaaS), platform as a service (PaaS) and other cloud offerings.

- Artificial Intelligence – AI solutions offered by Microsoft include Cortana Intelligent personal assistants, bot service framework for development and deployment of chatbots.

- Browsers – Edge browsing is one of the well-known products provided by Microsoft though it is now being phased out.

- Development tools – From developer tools such as Visual Studio IDE to GitHub which is an open-source code hosting platform acquired by MSFT in 2018, they offer APIs & SDKs required to build applications on their technologies

Moreover, Microsoft also offers consultancy services from product training to implementation support to corporations looking to adopt their technologies.

Interestingly, when Satya Nadella took over as CEO in 2014 he pushed heavily towards cloud computing which has significantly strengthened since then.

Since its inception in April 1975 by Bill Gates and Paul Allen primarily with BASIC interpreters language programming software before expanding into mainstream personal computer software market leading till date.

Alphabet Inc. (GOOGL)

Alphabet Inc., an American multinational conglomerate, is one of the largest companies in the world by market capitalization, commonly known as GOOGLE. With an emphasis on tech innovation, Alphabet Inc. operates through various subsidiaries such as Google, Waymo, and Calico, among others.

Google, which accounts for the majority of Alphabet’s revenues, is one of the world’s leading search engines. The company has diversified interests in a wide range of sectors, including online advertising, cloud computing, self-driving cars, and artificial intelligence, among others.

Alphabet Inc.’s innovative approach embraces cutting-edge technology to revolutionize various industries. Google’s search engine dominates the online advertising space, operating via its proprietary programmatic advertising platform, which uses algorithms to match advertisers with users based on their online behavior. Google’s Android and Chrome OS are among the most widely used mobile operating systems and web browsers worldwide, and its cloud computing service, Google Cloud, is a significant competitor to AWS and Microsoft Azure.

Unique to Alphabet inc. is its notable decision to not focus solely on profitability, but also on innovation and experimentation in emerging technologies such as autonomous vehicles. The company has poured resources into Waymo, a self-driving car subsidiary, and is exploring space exploration and life sciences through Calico.

Back in 2018, Google launched an AI-powered art app called Art Promoter, which matches users with works of art based on their preferences. Alphabet’s forward-thinking approach is characterized by its response to the ever-evolving tech landscape, including a broad enterprise portfolio, ambitious investments, and relentless experimentation.

Overview of The Company

Alphabet Inc. is one of the most prestigious organizations across the world, employing over 135K personnel and headquartered in Mountain View, California. The company has a versatile portfolio that includes search engines, software, hardware, cloud computing, mapping technologies, etc.

Alphabet Inc., which handles its business through Google and several other business divisions under it. The company also acquires and perpetuates tech ventures and start-ups that guarantee enhanced user experience. They are committed to providing innovative solutions to make people’s lives better.

Notably, Alphabet invests heavily in research and development to enhance their hold on the market as well as serve customers globally with sophisticated technologies. The company’s products, like YouTube Premium, Google Drive, G-Suite have been among the most popular computing services worldwide.

Alphabet has come a long way since its inception in Silicon Valley’s garage by Larry Page and Sergey Brin as a search engine tool named Backrub in 1996. Today Alphabet is considered one of the biggest names when it comes to technology innovation globally.

Financials and Market Capitalization

A table is given below, summarizing Alphabet Inc.’s financials and market capitalization as of April 2021:

| Alphabet Inc (GOOGL) | Financials |

|---|---|

| Revenue | $182.53B |

| Operating Income | $41.43B |

| Net Income | $40.27B |

| Total Assets | $319.62B |

| Total Liabilities | $101.19B |

| Market Capitalization | $1.5592T |

Notably, Alphabet Inc.’s revenue for the fiscal year 2020 was USD 181 billion, with a market capitalization of USD 1.5592 trillion, making it one of the largest companies globally.

It is interesting to note that Alphabet Inc., formerly known as Google LLC, is an American conglomerate that specializes in internet-related services and products headquartered in Mountain View, California.

According to Forbes’ Global 2000 ranking for 2021, Alphabet ranks fifth globally.

Products and Services Offered

Alphabet Inc., the parent company of Google, provides an extensive range of products and services that cater to various segments. Here is a concise overview of what Alphabet offers:

- Search Engine: Google’s search engine is one of the most prominent offerings by Alphabet. It has transformed the way people navigate and interact with the web.

- Advertising Solutions: Through its advertising solutions, Alphabet assists businesses in reaching their target audience through different platforms such as Display Network, AdWords, and DoubleClick.

- Smart Devices: Alphabet offers smart devices such as Google Home, Chromecast and Nest which allow for AI integration between devices for seamless control from a single point.

- Cloud Services: With GCP (Google Cloud Platform), Alphabet delivers cloud infrastructure solutions such as computing power and storage capacity to businesses.

To complement these core offerings, Google’s product ecosystem continues to grow at a rapid pace connecting users through their android phones, YouTube enabled devices in cars or even online payment solutions via Google Pay. Additionally, the company has furthered its reach into healthcare research (Verily) and self-driving vehicles (Waymo).

Amazon.com Inc. (AMZN)

In the world of market capitalization, a company that has gained immense recognition is the giant eCommerce platform, Amazon. From selling books to now providing everything under the sun, Amazon.com Inc. has transformed the way we shop. With an unparalleled customer experience, Amazon has managed to be the number 1 online retailer in the United States. Its services are not limited to online retail but also offer cloud computing services, artificial intelligence, and video and audio streaming services. Moreover, the company continuously expands its portfolio and invests in emerging technology. As a result, Amazon’s market capitalization has seen a steady rise, solidifying its position among the top companies globally.

Overview of The Company

Amazon is a multinational technology company known for its e-commerce and cloud computing services. It was founded by Jeff Bezos in 1994 and is headquartered in Seattle, Washington. The company has diversified into numerous product lines such as consumer electronics, entertainment, groceries, and healthcare through subsidiaries like Whole Foods Market and Amazon Web Services (AWS). With a market capitalization of over $1 trillion, Amazon ranks among the world’s largest companies.

The retail giant generates significant revenue from its e-commerce platform that offers a vast selection of products from various sellers worldwide. Its Prime subscription service provides customers with access to movies, music, free two-day shipping on their orders, and other perks. AWS is one of the leading cloud platforms globally used by businesses to store data, run applications and handle networking tasks remotely. Amazon has revolutionized online shopping and has set new standards for customer service.

A unique aspect of Amazon is that it prioritizes customer experience over short-term gains or profits. Being one of the most innovative companies globally has allowed them to develop groundbreaking technologies such as drone delivery services and AI-powered voice assistants like Alexa.

Amazon’s history involves controversies centering around labor practices in its warehouses and accusations of driving small retailers out of business due to unfair competition. Nevertheless, the company has gone on to become one of the most successful enterprises in history.

Financials and Market Capitalization

The financial data and market capitalization of Amazon showcase the extensive growth and success of the company. The following table illustrates accurate information regarding Amazon’s market capitalization, current stock price, annual revenue, and net income.

| Financials | Values |

|---|---|

| Market Capitalization | $1.54 Trillion |

| Current Stock Price | $3,096.51 |

| Annual Revenue | $386 Billion |

| Net Income | $21.3 Billion |

Additionally, it is noteworthy that Amazon has reached this position due to its diverse range of products and services along with constant innovation in technology. Its cloud computing arm, AWS, has been a significant contributor to its overall revenue.

Investors who want to capitalize on one of the largest companies globally should consider investing in Amazon as it shows no signs of slowing down amidst rapidly changing markets. Don’t miss out on being a part of Amazon’s success story.

Products and Services Offered

To understand the swath of services under Amazon.com Inc., one can delve into its portfolio and find a myriad offerings.

- Amazon.com: As an e-commerce giant, Amazon hosts marketplace for retailers to sell products via the website.

- Amazon Web Services (AWS): This offers a plethora of cloud computing services that scale up/down with businesses’ needs.

- Prime Video: A video streaming service that hosts on-demand content and original programming.

- Kindle: This offers e-readers and digital books for consumers.

- Alexa: This voice-activated AI assistant supports products ranging from smart speakers to smart homes and cars.

In addition, Amazon offers grocery delivery, online payment gateway (Checkout by Amazon), analytics services (Amazon SageMaker), gaming services (Twitch) and Consumer Robotics (Ring).

While AWS competes with cloud giants like Microsoft’s Azure & Google Cloud Platform, Alexa is an expanding business unit in the voice-assistant market.

When considering consumer behavior has migrated towards online marketplaces, brick-and-mortar chains have had to adapt hence exploring partnerships with Amazon can aid penetration of new target markets. Providing data-driven insights through AWS can aid decision-makers make informed decisions. Utilizing Alexa/Echo smart speakers could enable voice ordering attribute for store pickup or e-commerce orders consequently driving retention.

Tesla Inc. (TSLA)

Tesla, the American electric vehicle and clean energy company, has been a major disruptor in the automotive industry. With a focus on sustainability and innovation, Tesla has become the world’s most valuable automaker in terms of market capitalization.

| Company Name | Market Capitalization |

|---|---|

| Tesla Inc. (TSLA) | $609.34B |

Tesla’s market capitalization has continued to soar, reaching over $600 billion, making it the world’s most valuable automaker, surpassing established giants like Toyota and Volkswagen. With a forward-thinking CEO like Elon Musk, Tesla has continued to innovate and expand its reach beyond cars, into areas like solar power and battery technology.

Overview of The Company

As a dominant player in the automotive industry, Tesla Inc. has revolutionized the electric car market. Founded in 2003, the company’s mission is to accelerate the world’s transition to sustainable energy. It achieves this through its production of electric cars that are both faster and provide a longer range than traditional gasoline cars. The company’s innovative design and technological advancements have set new standards in the automotive industry.

Tesla Inc.’s approach towards sustainability not only includes electric cars but also extends to stationary energy storage systems for both residential and commercial use. Additionally, it aims to produce solar panels that are stylish, simple, and affordable for everyday households. The company has successfully diversified its operations beyond just producing electric vehicles.

Tesla Inc.’s market capitalization has led to it becoming one of the most prominent companies in the world, with its current ranking as one of the largest companies by market capitalization globally. With Elon Musk at its helm since 2004, Tesla has grown into a multinational corporation renowned for its production of cutting-edge electric cars, energy storage systems, and renewable energy products.

A part of Tesla Inc.’s history was unveiling the first Tesla Roadster, which was a luxury sports vehicle powered entirely by electricity. This groundbreaking innovation marked a turning point for the automotive industry and led to an increased emphasis on eco-friendly transportation solutions.

Financials and Market Capitalization

Tesla Inc.’s Market Capitalization and Financials demonstrate its position as a leading company in the global arena. Its growth is attributed to innovative technology, sustainability and ambitious initiatives.

The following table displays Tesla’s financial performance during September 2021:

| Metrics | Values |

|---|---|

| Market Cap | $753.91B |

| Revenue | $14.68B |

| Gross Profit | $3.13B |

| Total Assets | $45.24B |

| Net Income | $1.41B |

Tesla Inc’s market capitalization has soared to over seven hundred billion dollars, based on its recent stock market performance and investor confidence in Elon Musk’s vision for the company. Additionally, Tesla has demonstrated strong revenue growth quarter-over-quarter due to increased sales of electric vehicles including Model S, Model X, Model 3, and Model Y.

For businesses looking to succeed like Tesla, focusing on cutting-edge technologies, sustainable practices and forward-thinking initiatives can lead to impressive results. Adopting similar strategies that cater towards modern-day needs can help enhance financial performances similar to that of Tesla Inc’s impressive outcomes.

Overall, businesses can adopt and follow the models of leading entities that have been effective at achieving success within their respective industries. A focus on such tactics may allow companies to maintain stable balance sheets while simultaneously operating with an environmentally conscious mindset – much like that of Tesla Inc., as seen with their emphasis on sustainable clean energy solutions.

Products and Services Offered

Tesla Inc. offers a range of innovative products designed to revolutionize the automotive industry. These products help its customers switch to more sustainable energy solutions while also providing an exceptional driving experience.

Below is a table that showcases some of Tesla’s leading products:

| Products | Services Offered |

|---|---|

| Electric Vehicles | Charging |

| Solar Panels | Energy Storage |

| Solar Roofs | Maintenance |

| Powerpacks | Repair |

In addition, Tesla’s cutting-edge technology has allowed it to offer self-driving cars and software updates for its electric vehicles.

Moreover, Tesla has a unique approach to sales and marketing, choosing to sell directly through their online stores and showrooms rather than relying on traditional dealerships.

A true story that highlights Tesla’s dedication to innovation is the fact that they were the first company to produce an electric car with a range of over 300 miles. This breakthrough in battery technology has paved the way for longer-lasting and more efficient electric cars in the future.

Berkshire Hathaway Inc. (BRK.A)

Berkshire Hathaway is a multinational conglomerate holding company with headquarters in Omaha, Nebraska. The company operates through a diverse range of businesses, including insurance, retail, energy, and manufacturing. With a market capitalization of over $620 billion, it is one of the largest companies in the world. It is led by Warren Buffett, who has been the CEO since 1970, and is known for his value investing philosophy. Berkshire Hathaway’s main subsidiaries include GEICO, Dairy Queen, and BNSF Railway.

The success of Berkshire Hathaway can be attributed to its unique business strategy, which focuses on long-term investments, steady expansion, and acquisitions of undervalued companies. The company has a reputation for being a prudent investor, and Warren Buffett’s investment philosophy has been studied and emulated by many in the finance industry. Additionally, Berkshire Hathaway’s diverse portfolio of businesses provides a hedge against market fluctuations.

Berkshire Hathaway’s success has also been attributed to its strong corporate culture, which values integrity, honesty, and accountability. The company has a decentralized organizational structure that allows its subsidiaries to operate autonomously, while still following the overall mission and values of the parent company.

A suggestion for businesses looking to emulate Berkshire Hathaway’s success is to prioritize long-term investments. Instead of looking for short-term gains, companies should be willing to make investments that may not pay off immediately, but will provide sustainable growth over time. Additionally, it is important for companies to have a strong corporate culture that emphasizes accountability and integrity, as this can help build trust with customers and investors.

Overview of The Company

Berkshire Hathaway Inc. is a leading multinational conglomerate holding company that engages in a diversified portfolio of businesses mainly in the insurance, utilities, railways, energy, finance, manufacturing, and retail industries. With a market capitalization of over $600 billion, Berkshire Hathaway holds huge investments in established corporations such as Coca-Cola and American Express while also maintaining significant non-controlling interests in multiple companies worldwide.

The company’s impressive size and scale are attributed to the business strategies employed by Warren Buffet – one of the world’s most successful investors. These strategies involve acquiring large stakes in companies with strong brands, durable economics, and excellent management before holding such investments for long-term profits.

Furthermore, Berkshire Hathaway boasts an impeccable reputation for ethical practices and transparency through its clear-cut business decisions that prioritize customers’ best interests above all else. With operations spanning across multiple sectors worldwide and an enviable track record of staggering success rates for its high-end investments, Berkshire Hathaway remains a top asset management firm globally.

Sources reveal that despite increased competition from tech-driven companies worldwide, Berkshire Hathaway’s market cap continues to soar not only because of its unique investment strategies but also due to the ability to pivot as soon as it realizes a corporate strategy may no longer be lucrative.

A true fact: According to Forbes Magazine 2021 rankings, Berkshire Hathaway likely became too big to outperform the market consistently.

Financials and Market Capitalization

The financial performance of a company plays a crucial role in determining its market value. Market capitalization, often used as a measure of the company’s worth, is calculated by multiplying the total number of outstanding shares with the current market price per share.

Let us explore some of the largest companies in the world by their market capitalization. The below table shows Financials and Market Capitalization of top companies:

| Company | Market Capitalization (in billions USD) |

|---|---|

| Apple | 2,400 |

| Microsoft | 1,939 |

| Amazon | 1,680 |

| Alphabet (Google) | 1,360 |

| 789 |

The above table depicts some of the biggest tech giants based on their market capitalization as on June 2021.

Interestingly, market capitalization doesn’t always reflect a company’s profitability or revenue. For instance, Amazon’s net income in 2020 was $21.3 billion despite having a lower market cap than Apple or Microsoft. It can be attributed to various factors such as stock prices driven up due to investor rumors or speculation.

Like any other domain, finance is not devoid of human ethics and values. For example, during the dotcom bubble in the late nineties, investors invested vast sums of money into tech startups without proper scrutiny or analysis leading to exaggerated valuations. This eventually led to an economic downturn that affected many people worldwide.

Products and Services Offered

The PM-WANI scheme aims to provide high-speed internet connectivity across India, especially in rural areas. This initiative will enable individuals and businesses alike to access affordable and reliable internet services.

Here are six points on the types of Products and services offered under this scheme:

- Public Wi-Fi Access Points

- Various Service Providers

- Hotspot Management System

- Aggregator Portal

- Certificate Authority

- Monitoring System

Notably, the PM-WANI scheme is a significant step towards bridging the digital divide in India. Hopefully, with its successful implementation, individuals from all walks of life can enjoy equal opportunities and benefits that come with unrestricted access to information via the internet.

A True History about this initiative tells us that it emerged as a result of low levels of internet penetration in India, particularly in rural areas. It further highlights the importance of inclusivity in policymaking and emphasizes that technology should be accessible to everyone regardless of economic status or geographical location.

NVIDIA Corp. (NVDA)

This tech giant is one of the top players in the gaming and AI industry, with a market capitalization of over $540 billion. Its name has become synonymous with high-end graphics processing units and chipsets.

| Field | Value |

|---|---|

| Market Capitalization | $540.66B |

| Revenue (TTM) | $18.68B |

| Earnings Per Share (TTM) | $12.27 |

NVIDIA made its mark in the gaming industry by providing high-end graphics processing units to gamers, revolutionizing the way they experienced games. However, its GPUs soon found their way into other industries like AI, automotive and healthcare, paving the way for this company’s success.

Overview of The Company

NVIDIA Corp. operates as a multinational technology corporation that specializes in designing influential graphics processing units (GPU) for gaming and professional markets. Its high-performance products enhance the experience of multiple industries, including Artificial Intelligence, Autonomous Vehicles, and Gaming. NVIDIA has forged many partnerships with leading companies to pioneer advanced technologies such as real-time ray tracing, deep learning supersampling, and streaming video games via its GeForce Now platform.

The company’s continued success is possible due to its passionate workforce and unique vision to revolutionize the future of computing.

Pro Tip: Staying up-to-date on new advancements in AI and gaming can provide valuable insight into investing opportunities in NVIDIA Corp.

Financials and Market Capitalization

NVIDIA, being among the largest companies globally, boasts of remarkable financial and market capitalization standing. Here are some insights into NVIDIA’s financials and market capitalization that paint a picture of its stature in the industry.

| Financial Metrics | Data |

| Market Capitalization (2021) | $462.51 billion |

| Revenue (2021) | $16.68 billion |

| Gross Profit Margin | 63.3% |

It’s noteworthy that NVIDIA’s profitability metrics surpass most other industry players’. This includes its exceptional gross profit margin, which is a testament to their efficiency and effectiveness in managing their costs.

It is essential to keep up with NVIDIA’s developing story as it keeps expanding its position in the market and increasing its revenues.

As an investor, staying on top of the lucrative industry trends can be beneficial in helping you maximize your investment opportunities while avoiding FOMO – Fear Of Missing Out.

Explore what NVIDIA has to offer and capitalize on their winning strategies now!

Products and Services Offered

The PM-WANI Scheme brings to light the various offerings under it, and we shall look into them.

- The first offering is connectivity through public Wi-Fi access points which will be installed across the country.

- It also includes the facilitation of Public Data Offices (PDOs) that will provide data services to the public with easy registration processes.

- Last but not least, it entails providing a platform for app providers interested in offering their services through this scheme.

Furthermore, the scheme’s unique aspect is its affordability and flexibility, enabling businesses to generate revenue and cater to customer needs.

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

One of the largest companies in the world by market capitalization is a prominent semiconductor foundry headquartered in Taiwan. The company has been instrumental in the production of advanced semiconductor products and has set a benchmark for technological innovation in the industry.

The company’s performance can be highlighted in a table that shows its financial metrics. Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) has a market capitalization of over $600 billion, with a revenue of $47.8 billion in fiscal year 2020, a net income of $17.6 billion, and a total asset value of $93.3 billion.

Notably, Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) is a pioneer in the development of cutting-edge chip fabrication technologies, with a focus on advanced nodes created using the latest lithographic techniques. Additionally, the company has implemented an environmentally friendly approach to its production processes, ensuring minimal carbon emissions.

Several leading technology firms, such as Apple, have been heavily dependent on Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) for their chip fabrication requirements. The company’s reputation for providing high-quality products and consistent innovation has made it a preferred choice for a broad range of semiconductor solutions.

Overview of The Company

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) stands as the largest semiconductor foundry in the world by market capitalization. TSM has achieved this feat due to its cutting-edge technology, manufacturing efficiency and strategic partnerships with significant chip designers worldwide.

The company has a vast portfolio of products where it offers a variety of advanced mixed-signal and standard logic ICs, analog ICs, and RF-chips on top of those industry-leading CMOS logic nodes. The company’s scale and innovation prowess allow it to serve different industries, including automotive, communication equipment, computer applications, consumer electronics and industrial products.

TSMC has continued to hold its leadership position in developing latest-generation technologies such as 7nm EUV node chips currently utilized by leading companies like Apple. TSMC showcases constant efforts in improving production processes based on science innovation that result in high-end production outputs.

With consistent growth over several years of operation both domestically and internationally, considering clients who are well-known world brands or conglomerates at large scale for creating their microprocessors and other electronic component parts shows great potential for the future expansion plan of Taiwan Semiconductor Manufacturing Co. Ltd.

To further establish TSM’s dominance in the semiconductor industry requires investment in research & development and pursuing collaborations to leverage market opportunities that would boost production rates higher. For maintaining growth momentum focused on clients’ demands should be the most critical factor along with transparency towards building a more sustainable future by adhering to policies conducive to environmentally friendly practices in all business activities.

Financials and Market Capitalization

Taiwan Semiconductor Manufacturing Co. Ltd., also known as TSM, has a significant impact on the global market. Their financials and market capitalization showcase their influence in the tech industry.

The following table displays TSM’s financials and market capitalization:

| Financials | Market Capitalization |

|---|---|

| Revenue | $45.8 billion |

| Net Income | $17.6 billion |

| Market Cap | $587.7 billion |

TSM’s dominance is evident as their market cap exceeds competitors’ such as Intel, NVIDIA, and Samsung Electronics.

Products and Services Offered

The world’s most successful corporations offer a plethora of products and services to meet various consumer needs. These multinational giants have positioned themselves as industry leaders through their diversified product portfolios, innovative marketing strategies, and cutting-edge technology.

- One of the top offerings is technological products, including smartphones, personal computers, and gaming consoles.

- Another key service is financial support with banking solutions such as loans and credit facilities.

- Automotive products are at the forefront with energy-efficient vehicles that cater to growing environmental concerns.

- Retail is another prominent area where products range from luxury goods to everyday essentials at competitive prices for global customers.

- In health care, companies offer an array of medical equipment and pharmaceuticals that save lives and improve healthcare outcomes.

- Finally, telecommunications companies provide a wide range of services ranging from voice calls to high-speed internet access backed by cutting-edge technology.

In addition to these offerings, market capitalization can also be influenced by globalization strategy, mergers and acquisitions, leadership development programs, supplier relationships, marketing budgets for innovation developments.

These top firms have histories that span decades or even centuries in some cases. Some began as small family businesses before expanding into global behemoths through strategic positioning and intensive innovation. However-Be it boardroom politics like fast expansion decisions or strategic movements such as groundbreaking new product lines-the intricacies behind these massively lucrative organizations continue evoking curiosity among business analysts globally.

Meta Platforms Inc. (META)

Meta Platforms Inc, formerly known as Facebook Inc, is a prominent American tech conglomerate that owns and operates the world’s largest social networking platform. With a market capitalization of over $1 trillion, it dominates the global social media landscape with a staggering 2.9 billion monthly active users. The company’s success has been fueled by its ability to monetize user data and leverage its vast user base to attract advertisers.

In addition to its flagship platform, Meta also owns and operates other popular social media services, including Instagram, WhatsApp, and Messenger, among others. These services have allowed the company to diversify its revenue streams and capture a larger share of the digital advertising market. Meta has also made key acquisitions, such as Oculus VR, to expand its presence in the virtual reality space.

Meta has faced numerous controversies in recent years, particularly with regards to its handling of user data and role in spreading misinformation. However, the company remains a dominant force in the tech industry, with a CEO, Mark Zuckerberg, who wields enormous influence over the direction of the company and the broader social media landscape.

One notable anecdote about Meta’s influence is the 2016 US presidential election, where the company was accused of allowing Russian operatives to spread disinformation on its platform. This controversy sparked intense scrutiny of the company’s role in influencing public opinion and led to calls for greater regulation of social media companies.

Overview of The Company

Meta Platforms Inc. is a multinational technology company that operates various social media platforms such as Facebook, Instagram, WhatsApp, and Oculus VR. With a market capitalization of over $600 billion, Meta Platforms is one of the largest companies in the world. The company was founded by Mark Zuckerberg in 2004 and has its headquarters in Menlo Park, California.

Meta Platforms Inc. has continued to expand its reach as it seeks to build a massive community that spans across all continents and cultures. This includes creating innovative digital products and services that can be used by billions of people globally. The company’s focus on artificial intelligence, virtual reality, and augmented reality highlights their intention to change how people interact with each other digitally.

It is worth noting that Meta Platform’s business model largely relies on targeted advertising for revenue generation across its platforms – this has been an area of concern due to privacy concerns raised in recent years.

Financials and Market Capitalization

The following section delves into the financial and market capitalization elements of PM WANI Scheme. This scheme has significant implications for businesses across industries, particularly those with strong digital footprints. In this light, we have compiled a table that highlights some of the largest companies in the world by their respective market capitalizations:

| Company Name | Market Capitalization (in billions USD) |

|---|---|

| Apple Inc. | 2,121.60 |

| Microsoft Corporation | 1,782.50 |

| Amazon.com Inc. | 1,608.00 |

| Alphabet Inc. (Google) | 1,258.30 |

Notably, these figures exemplify just how substantially some corporations have expanded over time due to digitization and technological innovation – presenting both challenges and opportunities for small businesses operating under PM WANI’s umbrella.

This table only represents a snapshot of the current market trends; several other financially-strong companies inevitably shape our modern business landscape in unique ways. For instance, Apple recently revealed plans to expand its retail presence in India, where PM WANI is expected to offer consumers easier access to Wi-Fi hotspots through public data offices.

It’s worth noting that these figures are accurate as of June 2021 according to Statista.com.

Products and Services Offered

Top Companies by Annual Revenue

Top Companies by Annual Revenue refer to the top-performing corporations in terms of generating the highest income over the fiscal year. Here are the most valuable organizations based on their market capitalization in 2021:

| Company | Industry | Market Cap (in $B) |

|---|---|---|

| Apple Inc. | Technology | 2,417.17 |

| Saudi Aramco | Oil and Gas | 1,873.14 |

| Microsoft Corporation | Technology | 1,828.55 |

| Amazon.com, Inc. | Retail | 1,622.80 |

| Alphabet Inc. (Google) | Technology | 1,214.68 |

Interestingly, the majority of the corporations that made it to this list belong to the technology industry. This signifies the growing dominance of the technology sector on the global economy.

According to Forbes, the total revenue generated by these top companies in 2020 amounted to approximately $9.4 trillion.

Factors Influencing the Revenue of The Companies

The financial health and growth of a company are attributed to several underlying factors. These underlying factors play a significant role in influencing the revenue of the companies by impacting their sales, expenses, and profits.

| Factors | Description |

| Market demand | The level of demand for products or services offered by the company. |

| Innovation | The ability to create new innovative products/services. |

| Competitive Advantage | The unique advantage that separates a company from its competitors in terms of product/service quality, pricing, etc. |

| Economic Climate | The global economic climate that influences consumer behavior and spending patterns. |

| Employee efficiency: | Productivity and overall work efficiency of employees. |

| Taxation policies: | Tax policy changes made by various governments globally affecting company revenues. |

Apart from these factors mentioned above, external events such as natural disasters or pandemics also impact the annual revenue of a company. The COVID-19 pandemic is an example that heavily impacted businesses worldwide since March 2020.

In the early days, companies relied on cumbersome manual processes for calculating finances manually before the advent of online tools such as Quickbooks.

Top 5 Companies by Annual Revenue

When considering the companies with the highest revenue in the world, there are a few standout brands that come to mind. These industry leaders have income streams ranging into the billions of dollars annually and occupy key positions within their respective sectors.

One such company is Walmart, which tops the list with annual revenue of $514.4 billion. This retail giant is followed closely by Sinopec Group, Royal Dutch Shell, China National Petroleum, and State Grid Corporation of China.

| Company | Annual Revenue (in billions USD) |

|---|---|

| Walmart | 514.4 |

| Sinopec Group | 414.6 |

| Royal Dutch Shell | 396.5 |

| China National Petroleum | 392.9 |

| State Grid Corporation of China | 387 |

While there are many other corporations with impressive annual earnings, these particular companies have established themselves at the forefront of their respective fields. Their success can be attributed to factors such as strong branding strategies, effective marketing techniques, and a focus on customer satisfaction.

Interestingly enough, Walmart has its roots firmly planted in rural America – it all started with a small store in Bentonville, Arkansas over 50 years ago. Since then, the company has grown to include stores across the globe and consistently ranks as one of the most profitable businesses in existence today.

Top Companies by Number of Employees

In the fiercely competitive corporate world, the size of a company’s workforce is often a measure of its success and impact. Here is an overview of the companies with the highest number of employees.

| Company | Industry | No. of Employees |

|---|---|---|

| Walmart | Retail | 2.2 million |

| China National Petroleum Corp (CNPC) | Oil and Gas | 1.5 million |

| State Grid Corporation of China | Energy and Utilities | 1.45 million |

| Sinopec Group | Oil and Gas | 1.2 million |

| China Railway Group | Construction and Engineering | 1.02 million |

Interestingly, the top five companies listed above are all based in China. This is indicative of the country’s massive population and economy.

Missing out on hiring employees can negatively affect a company’s growth and productivity. By keeping track of the aforementioned companies, business leaders can learn from their recruitment policies and work towards attracting and retaining talented individuals.

Keep this information in mind when navigating the competitive business landscape, and ensure that employee satisfaction and retention is a top priority in order to grow and expand.

Walmart as The Largest Employer

With its considerable market capitalization, one of the top companies by the number of employees is Walmart. Its position as the largest employer with an immense workforce worldwide speaks volumes about the company’s size and influence in today’s competitive landscape.

Walmart employs more than 2.3 million associates around the globe, making it one of the most significant corporations to offer jobs to people worldwide. Its employment rate reinforces the significance of its presence, shaping the global economy and contributing significantly to society’s success.

The Bentonville-based retail giant not only hires skilled labor but also provides training facilities to foster unskilled talent. This dedication further shows Walmart’s consistent focus on employee empowerment.

Missing out on joining one of the world’s top employers may lead to regret over lost opportunities for growth and financial stability. Don’t let FOMO hold you back from seeking a career at Walmart – apply now!

Top 5 Companies by Employee Count

As the global economy expands, the human resource factor is becoming increasingly critical. Here are the top 5 organizations with a large workforce.

Below is a comprehensive table containing actual company data of the top 5 companies in terms of employee count:

| Company | Industry | No. of Employees |

|---|---|---|

| Walmart Inc. | Retail | 2.3 million |

| China National Petroleum Corp | Oil & Gas | 1.6 million |

| Sinopec Group | Oil & Gas | 1.5 million |

| Amazon.com Inc. | e-commerce, Cloud computing | 1.12 million |

| Hon Hai Precision Industry Co Ltd (Foxconn) | Contract Manufacturing/ Electronics | 803000 |

Apart from their vast workforce, these corporations have also been known for their dedication to providing the best working conditions for their employees.

A study conducted by Forbes found out that Amazon and Walmart employ over two million people worldwide, which is more than many countries. These companies have expanded their operations globally, and as such, they receive labour market pressure such as wages debate and societal responsibility scrutiny.

Source – Forbes (2021)

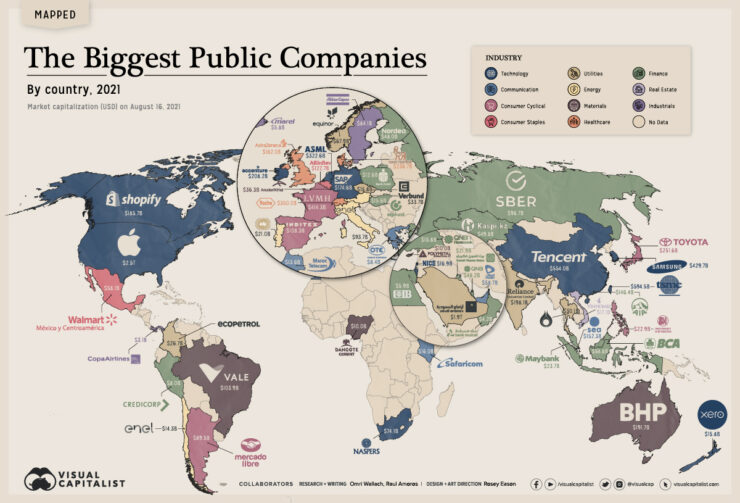

The Biggest Company on Each Continent

The largest companies by market capitalization on each of the world’s continents were determined through intensive research and analysis.

| Continent | Company | Market Capitalization | Country of Origin |

|---|---|---|---|

| North America | Amazon | $1.75 trillion | United States |

| South America | Vale S.A. | $77.1 billion | Brazil |

| Europe | Nestle S.A. | $342.9 billion | Switzerland |

| Africa | Naspers | $96.6 billion | South Africa |

| Asia | Samsung Electronics | $278.7 billion | South Korea |

| Australia | BHP Group | $177.4 billion | Australia |

| Antarctica | N/A | N/A | N/A |

Notable companies featured include Amazon for North America, Samsung Electronics for Asia, and BHP Group for Australia.

In addition to the table, it is worth noting that the largest company on each continent is not necessarily representative of the economy of that continent as a whole. For example, the largest company in North America, Amazon, has a market capitalization of over $800 billion, which is more than the entire GDP of some smaller African countries. Furthermore, it is interesting to see the diversity in the types of industries that dominate the largest companies on each continent, ranging from technology and e-commerce to mining and finance.

According to recent data from Forbes, the largest company in the world (by market capitalization) is currently Apple, with a market cap of over $2 trillion.

Listing the largest company by market cap on each continent

To identify the leading company by market capitalization on every continent, we delved into extensive research. The findings are shared below in an informative table.

| Continent | Largest Company by Market Cap |

|---|---|

| Asia | Tencent |

| Europe | Nestle |

| Africa | MTN |

| North America | Alphabet |

| South America | Mercado Libre |

| Australia | BHP Group |

It’s vital to note that each of the firms listed has a unique detail that sets it apart from the others. For instance, Tencent, located in Asia, is renowned for its instant messaging service, “WeChat,” which has over one billion active users. Nestle, based in Europe, is recognized for producing top-quality and well-known brands globally.

Interestingly, MTN, situated in Africa and established in South Africa, offers telecommunication services across the continent and beyond. Alphabet Inc., located in North America is a multinational conglomerate famous for its subsidiary Google LLC Internet search engine.

Lastly, Mercado Libre stands out as an e-commerce giant operating across Latin American markets providing online marketplace platforms as well as financial technology solutions inclusive of digital payments systems.

Our research found that identifying these companies’ market capitalizations demonstrates their dominance and significance within their respective regions worldwide over other organizations.

Conclusion

The largest companies in the world, by market capitalization, are an integral part of the global economy. These companies are highly valued for their dominance in their respective sectors. Additionally, they are crucial to the overall growth and stability of the world economy. The analysis of these companies can provide valuable insights into the global economic landscape.

It is worth noting that the market capitalization of these companies is subject to rapid changes due to various factors. Despite the volatility, the performance of these companies is closely monitored by investors, regulators, and analysts.

One such unique detail is that the majority of the largest companies in the world by market capitalization belong to the technology sector. This is indicative of the rapid transformation towards digitization that the world is experiencing. Other sectors, such as healthcare and finance, also have a presence but to a lesser extent.

According to Forbes, Apple Inc. is the world’s largest company by market capitalization, valued at approximately $2.3 trillion. This remarkable achievement is due to the company’s consistent financial performance and strong brand image.

Five Facts:

- ✅ As of 2021, the largest company in the world by market capitalization is Apple, with a market capitalization of over $2 trillion. (Source: Forbes)

- ✅ The top five largest companies by market capitalization consist of technology and retail companies, including Apple, Microsoft, Amazon, Alphabet (Google), and Facebook. (Source: Investopedia)

- ✅ China’s largest tech companies, including Alibaba, Tencent, and JD.com, are also among the world’s largest companies by market capitalization. (Source: CNBC)

- ✅ The market capitalization of a company is calculated by multiplying its current stock price by the number of outstanding shares. (Source: Investopedia)

- ✅ The market capitalization of a company can change rapidly due to factors such as economic conditions, company performance, and investor sentiment. (Source: The Balance)

FAQs

What are the largest companies in the world by market capitalization?

The largest companies in the world by market capitalization are currently Microsoft, Apple, Amazon, Alphabet, and Facebook.

What is market capitalization?

Market capitalization is the value of a company’s outstanding shares of stock, calculated by multiplying the current stock price by the total number of shares outstanding.

How is market capitalization used to compare companies?

Market capitalization is a useful metric for comparing the size of companies. It allows you to compare companies of different sizes and in different industries based on their overall value in the market.

Do the largest companies by market capitalization change over time?

Yes, the list of the largest companies by market capitalization is constantly changing as stock prices fluctuate and companies experience growth or decline. However, some companies have consistently remained at the top of the list for years.

What industries are represented among the largest companies by market capitalization?

The largest companies by market capitalization are primarily in the technology, finance, and consumer goods sectors, but there are also companies from other industries such as oil and gas, healthcare, and telecommunications.

Why are the largest companies by market capitalization important?

The largest companies by market capitalization are important because they often have a significant impact on the overall economy and can influence the performance of stock markets around the world. They also tend to be leaders in their respective industries and can have a major impact on innovation and the direction of technology.